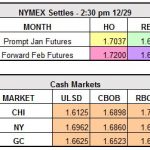

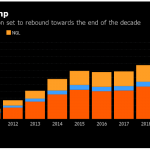

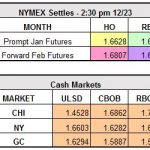

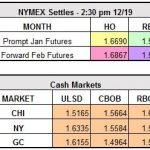

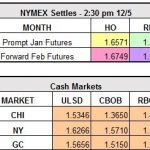

What a move for crude prices in December. WTI prices have risen more than 16% this month to $53.67/bbl today on the heels of the OPEC/non-OPEC production cut deal which will begin in January. However, with prices in December ending sharply higher, many are wary that prices have the potential of falling in January once […]

Read MoreWhat Will Happen in January?