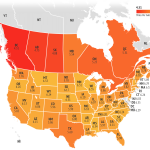

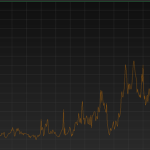

Has this ever happened to you? You are scouring your local market for diesel or gasoline product, can’t find any, and then end up needing to go somewhere else for product? A supply disruption is no fun for anyone involved. Take a look at the inventory chart above. This depicts the national distillate supply situation […]

Read MoreKeep your business on track during a supply disruption