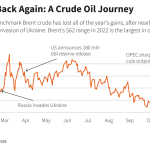

They say fuel prices shoot up like a rocket and fall like a feather. We’ve seen yet another example of that this week as the benchmark diesel price used for fuel surcharges has eclipsed $4 per gallon. This is about a 20-cent increase from the prior mark of $3.89. While several factors can impact this […]

Read MoreBenchmark Diesel Price Eclipses $4/gal for First Time Since October