As we near the end of 2016, the bulls appear to have grabbed the market by the horns. Prices are close to the highs of the year as we edge closer to the January OPEC production cuts. We expect these high prices to be sustained into the holidays for other reasons as well.

Many states will be increasing gasoline and on-road diesel taxes effective January 1st. For instance, in our home state of Pennsylvania, gasoline and on-road diesel taxes will increase 8 and 10.7 cents per gallon, respectively.

In case you haven’t realized from your heating bills, it has been quite cold over the past two weeks. Thanks Polar Vortex. This has spurred a lot of demand for heating oil, keeping the February heat crack trading above $17. This is the price refineries watch to make profit once they “crack” the crude into heating oil. This time last year, the heat crack was trading around $12…signaling that today’s demand is up compared to last year.

From a supply perspective, at the end of every year large producers and refiners that store crude oil normally draw down their inventories. They do this so they have less taxable assets when Uncle Sam knocks and asks for year-end figures to collect his check. These drawdowns are noticed by the market and prices can rise to offset the lower supply levels.

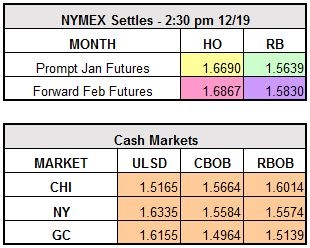

Given all of these reasons, the market may be propped up for a few more weeks until we get reports on OPEC’s compliance with regards to their targeted production cut levels. At writing, WTI crude trades up $0.19 at $52.31/bbl, RBOB is up $0.019 at $1.5829/gallon, and ULSD trades down $0.0032 at $1.6658/gallon.