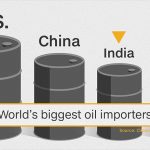

We are a mere 7 days into a new year, and have already seen the first oil rally in the markets. Many factors have played a role in the first rally of the new year. Oil has been tumultuous over the last 11 months but has seen some stability and positivity since Biden’s election win […]

Read More2021 Oil Rally; Biden confirmed as the 46th POTUS