As some of us start our week today, trading is light throughout the entire oil complex, thanks to the corporate holiday yesterday. This is expected to continue throughout the week as many traders are out on vacation. This “light” trading means that we could see big swings in prices because there aren’t a lot of market players, which increases volatility.

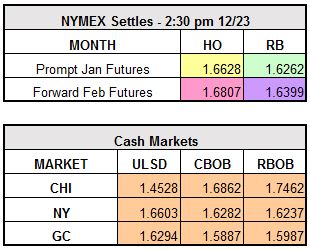

This is part of the reason the Jan ULSD market is trading up 4.42cpg at $1.7070/gallon at writing this morning. This light trading is amplified by the fact that many traders need to “roll” January futures positions to February, meaning that if you have to buy a January contract, the price you buy at may be squeezed up.

Besides the low liquidity, the up day today can be attributed to more and more market participants believing in OPEC’s production cut which will start next week. There’s a lot of optimism that each country will be able to adhere to their targeted production cuts; we’ll be able to grade them on compliance in a few weeks.

Feb WTI crude and Jan RBOB currently trade up $0.90 and $0.0358 to $53.92/bbl and $1.6620/gallon, respectively.