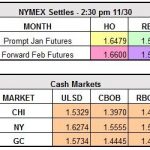

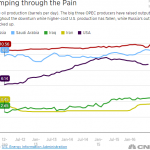

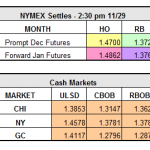

What an incredible, roller-coaster of a week we’ve been on due to OPEC’s historic decision to cut production on Wednesday. Many market participants were skeptical of a deal being done, as evidenced by the rally we’ve been on for the past three days.

Read MoreOPEC Rallies the Market