The oil market has found a bid today on the heels of strong Chinese oil import demand, continued strife in Iraq, and international traders covering shorts after yesterday’s DOE report.

Read MoreMarket Flies Like An Eagle

The oil market has found a bid today on the heels of strong Chinese oil import demand, continued strife in Iraq, and international traders covering shorts after yesterday’s DOE report.

Read More

The API’s came out yesterday afternoon and showed a build in crude of 3.1 million bbls. 1 million of that being in Cushing, OK. Distillates built 2 million bbls and gasoline drew 1.6 million bbls. Expectations were for crude to drop about 1.7 million bbls according to analysts in a Wall Street Journal survey. The […]

Read More

It is profit-taking Friday as front-month WTI crude decisively breaks below $50/bbl despite Tropical Storm Nate shutting down Gulf of Mexico oil production as it eyes the U.S. coastline.

Read More

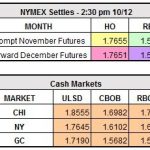

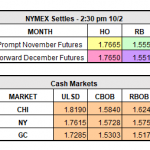

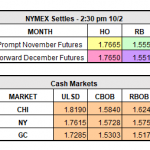

The market continued its downward trend yesterday, front month HO closed $0.0435 to $1.7665/gal, front month RBOB closed down $0.0357 to $1.5553/gal and WTI crude $1.09 to $50.58/bbl. Just one week ago heating oil was trading almost 10 cents higher and RBOB was trading nearly 17 cents higher.

Read More

The oil markets are taking a much needed breather this morning and are lower by about 2% after Brent crude had posted its largest third quarter price increase in 13 years. Multiple factors are in play putting pressure on the energy sector. The first factor is the stronger U.S. dollar. With the dollar strengthening, oil […]

Read More

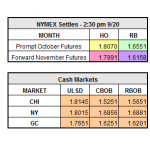

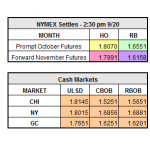

After posting a down day across the board in the energy sector yesterday, this morning’s activity is trending lower in early trading. Yesterday’s settles saw crude drop $0.58 to finish the session at $51.60, while the refined products closed off $0.0143 and $0.0222 for Heating Oil and RBOB to finish at $1.8320 and $1.6318 respectively. […]

Read More

OPEC continues to use strong rhetoric to start the week and crude prices continue to respond. Reuters reports that “November Brent crude futures contract was up 89 cents at $57.75 a barrel by 1204 GMT, its highest since January 3.” Over the past 3 months the world has seen the price of oil rise by […]

Read More

Ministers from both OPEC and non-OPEC producers left Vienna today with no new policy recommendations. The market was unenthused by the result as we trade sideways. Now, the attention turns to the refining situation which has led to distillate supply tightness and North Korea’s alarming hydrogen bomb threat.

Read More

Now that U.S crude production is slowly getting back on its normal track, it is likely we will see a near-term pull back in crude oil price. We continue to see the inverse relationship between crude prices and U.S. production in the markets. From their highs of $107/bbl in 2014, crude oil prices have since […]

Read More

The battle of the bulls and the bears ensues as we try to determine if the right price for WTI is above or below $50/barrel. All the while we’re watching the latest storm to be named today off the western coast of Africa.

Read More