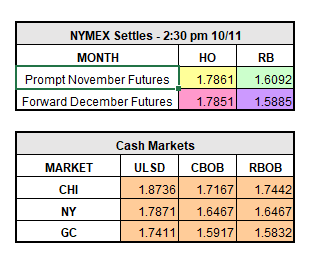

The API’s came out yesterday afternoon and showed a build in crude of 3.1 million bbls. 1 million of that being in Cushing, OK. Distillates built 2 million bbls and gasoline drew 1.6 million bbls. Expectations were for crude to drop about 1.7 million bbls according to analysts in a Wall Street Journal survey. The market has come off since the build in crude inventories after settling up across the board yesterday. Front month heating oil closed up $0.0212 to $1.7861/gal, front month RBOB closed up $0.0177 to $1.6092/gal, and WTI Crude closed up $0.38 to $51.30/bbl.

The DOE Statistics that came out at 11:00 a.m. EST reported a draw in crude of 2.7 million bbls, a draw in distillates of 1.5 million bbls, and build in gasoline of 2.5 million bbls. These statistics are the exact opposite of what the API’s reported. The market seems to be unenthused about the DOE report, Heating Oil is still trading down despite the draw inventories, and gasoline is trading down but not as much as one would expect with the 2.5 million barrel build.

As for an update on OPEC, they are still expected to extend cuts beyond the initial expiry date of March 2018. It is still unknown how long they are expected to extend beyond this date. OPEC’s intention is to raise crude oil prices by cutting production, but production in the U.S. has kept a cap on any price increases. U.S. production will make any major uptick extremely difficult.

Gasoline prices are down 6 cents at the pump since last week, and now almost 20 cents lower than just one month ago. The average price at the pump as of Wednesday for regular gasoline is $2.478/gallon.