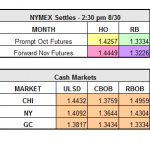

The market took a big turn south yesterday due to continued strength of the U.S. dollar, and somewhat bearish statistics on the DOE report yesterday morning. The API report on Tuesday evening kick-started the downward momentum, showing a build in crude of nearly 1 million barrels, and a build of 3 million barrels on distillates. […]

Read MoreThe Bears Have Escaped From the Zoo