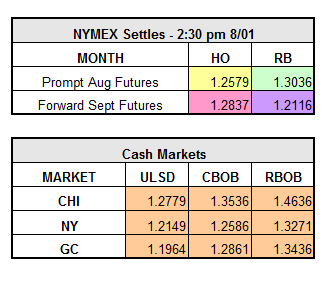

The market is continuing on the down-trend this morning, trading at a penny loss on refined products. Over the past two weeks, we’ve seen HO drop off by over 12.5 cents and RBOB fall by over 7 cents on supply glut concerns. Yesterday, HO settled down $0.0496 to $1.2579 and RBOB lost $0.0158 to $1.3036. September WTI Crude fell $1.54 to $40.06, falling below $40/bbl for the first time in three months. Despite a significant loss on the NYMEX, the Chicago cash market finished with gains on all products due to a multitude of refinery issues.

Refinery problems in Chicago include production issues at BP’s 430,000 bpd Whiting, Ind. plant, an unplanned repair at Marathon’s 225,000 bpd Robinson, Ill. refinery, planned maintenance at Phillips 66’s Wood River, Ill. plant, and numerous issues at BP’s Toledo, Ohio, facility, Husky’s Lima, Ohio, refinery, and at CITGO’s Lemont, Ill. refinery. Spot prices for gasoline and diesel in Chicago-influenced markets (Ohio and west) are likely to drive upward.

The market is losing interest in the $274 billion Japanese stimulus package approved yesterday by Prime Minister Shinzo Abe. As Japan’s largest stimulus program since the 2008 recession, the package seems substantial, however a deeper look shows the numbers to be less exciting. Low interest loans from government and state-owned companies will make up 75% of the package, leaving only $74.4 billion in new spending over the next couple of years.