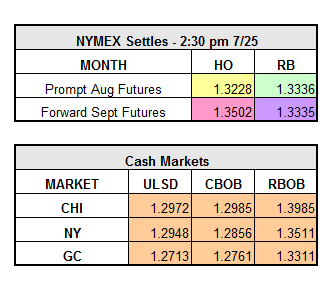

Yesterday, oil prices hit 3-month lows with HO settling down $0.0342 to $1.3228, RBOB finishing down $0.0279 to $1.336, and September contract WTI crude losing $1.06 to $43.13. The fourth consecutive day of down trend in oil prices continues this morning on economic uncertainty, with refined products trading slightly negative on the NYMEX. Although interest rates are expected to remain unchanged, anticipation of the U.S. Federal Reserve Bank meeting to discuss monetary policy may cause market volatility throughout the day. Also, with September taking over as front-month contract for refined products on Friday, the August contract prices are declining.

Also putting pressure on the market, without surprise, is the ongoing supply glut. July gasoline inventory levels have hit a record high, and with increased production and imports, stocks continue to rise. Despite growing levels of gasoline demand, demand is unlikely to make a meaningful impact on the market until some of the supply glut has been tackled. At the pump, gasoline prices are at a national average of $2.1510 a gallon, with about 50,000 retail sites below $2 a gallon. Prices have already dropped over 15 cents this month, and with no summer hurricane in sight prices may continue to fall.

According to the IEA, OPEC’s June output was recorded at an 8 year high of 33.21 mbpd, with Iran and Saudi Arabia continuing to fight for market share. Post-sanctions, Iran has boosted its market share over 11%, causing other Gulf producers such as Saudi Arabia, Kuwait, and UAE to lose a combined share of over 3%. The National Iranian Oil Company claims the country has regained 80% of its pre-sanction oil market share.

The 24-hour strike protesting a possible 30% cut on pay and allowances for about 400 Royal Dutch Shell PLC oil and gas workers began this morning. The platforms are currently undergoing maintenance, therefore the strike is unlikely to affect markets.