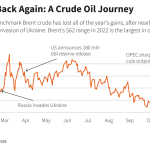

Crude oil is having an uncharacteristic mid-summer surge, providing commodity markets volatility, and driving refined products pricing higher. The outlook has been bullish for crude and refined prices for late 2024, despite global recessionary fears, and this may only be the beginning of the rise of crude oil. Numerous factors are behind the sudden rise […]

Read MoreUp, Up, and Away; Crude’s Unexpected Summer Rise