We are a mere 7 days into a new year, and have already seen the first oil rally in the markets. Many factors have played a role in the first rally of the new year. Oil has been tumultuous over the last 11 months but has seen some stability and positivity since Biden’s election win in November. Biden was confirmed by the senate to be the 46th President of the United States of America and he will have a democratic controlled House and Senate to put his plans into action.

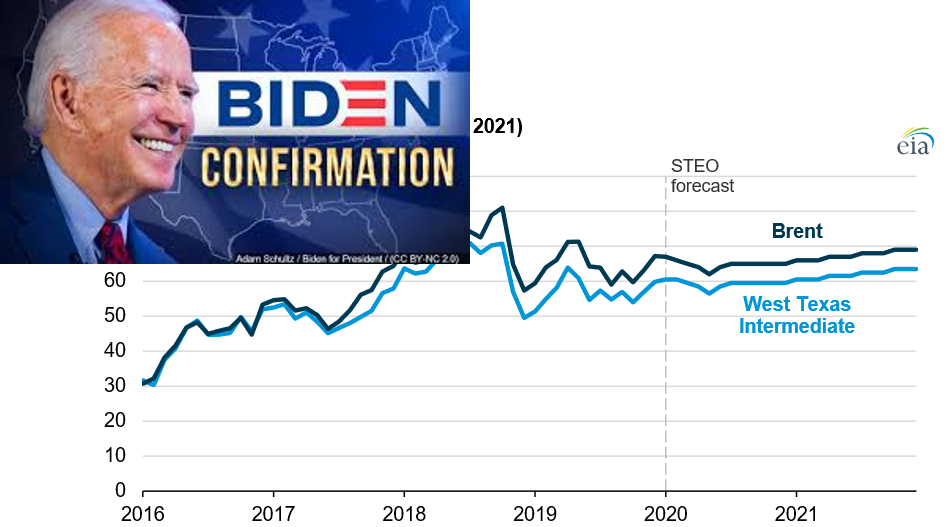

There were several factors that led up to this first oil rally that has crude up over $50/bbl. Yesterday, as the US awaited anxiously for what was to come of the presidential election, OPEC met and collectively decided to continue the production cuts for yet another month. The biggest surprise came from Saudi Arabia when they decided to voluntarily cut an additional 1 million barrels a day for February. This was the first major boost to oil markets. Additionally, the EIA reported draws in commodities that were beneficial to the oil markets. They also forecasted that oil would remain above $47/bbl in 1Q21 and gradually rise above $50/bbl by 4Q21.[1]

Today the world woke to the news that the Senate had confirmed president-elect Joe Biden in the early morning hours of January 7, 2021. Most experts predict this will also have an encouraging impact on the oil markets as they have been responding positively to a Biden win since November. His campaign promises of limiting US drilling and fracking is optimistic news worldwide. Less US drilling and fracking would tilt the overall supply and demand. Many believe that this would create less supply even through COVID-19 demand destruction that is expected to continue well into 2021. [2]

Biden ran on promises of defeating COVID-19 with mask and lockdown mandates. These are policies that indicate more demand destruction. He also promised cleaner and renewable energy investments and fracking bans across the US. These promises suggest lower supply and less inventory builds. Bulls are optimistic and three key factors may play a role in why they potentially have the upper hand. The US Shale industry is recovering and most of the major players are emerging undervalued and much better fundamentals with the ability to survive at $35/bbl. Additionally, IEO (US oil and gas exchange fund) has surged 46% or 7.3% YTD.

Lastly, the XLE, the proxy which holds all the oil majors, has a fund that is up 36% in the last 90 days.[3] Whether you are bullish or bearish, talk to a Guttman sales team representative today to navigate the turbulent commodities markets.

[1] https://oilprice.com/Energy/Oil-Prices/OPEC-Meeting-Ends-With-Major-Surprise-Cut-From-Saudi-Arabia.html

[2] https://oilprice.com/Energy/Energy-General/WTI-Tops-50-As-Oil-Rally-Continues.html

[3] https://oilprice.com/Energy/Energy-General/How-To-Play-2021s-First-Oil-Rally.html