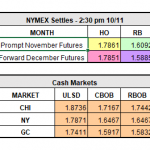

All eyes this week are on OPEC! Come Thursday this week OPEC will finally be meeting in Vienna to discuss their plans for extending production cuts. There is still discussion that Russia is undecided on how they feel about further extending the cuts, but as of right now the consensus is that production cuts will […]

Read MoreU.S. Production Peaking as OPEC Prepares for Meeting