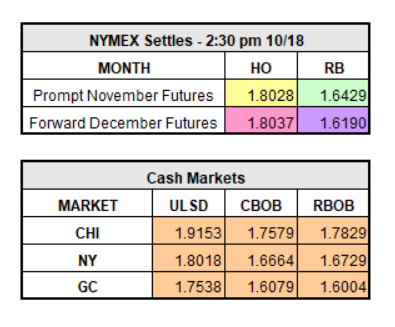

The market was relatively quiet yesterday closing down $0.0070 to $1.8028/gal on November HO and closing up $0.0128/gal on November RBOB to $1.6429/gal. Much to everyone’s surprise, crude inventories fell for the 4th consecutive week yesterday by 5.7 million barrels. Analysts feel that the inventory draw and decrease in production were skewed by the effects of Hurricane Nate. Hurricane Nate certainly didn’t get the same headlines as Harvey or Irma, but it has crippled U.S. oil production in the Gulf of Mexico nonetheless.

Another piece of important news to note is that the “Fragile Five” which are Iran, Iraq, Libya, Nigeria, and Venezuela are still facing potential supply issues due to the tensions rising between the Kurdistan Regional Government, Baghdad, and Turkey.

OPEC’s next meeting is scheduled for November 30th to determine what their next move will be in regard to production cuts for the 2018 calendar year. As of right now their 1.8 million barrel a day cuts are scheduled through March of 2018, but they are expected to extend the cuts at least through 2018. According to OPEC, “A balanced market is in sight”.

Currently as of 10:23 a.m. EST the market is trading down $0.0225 on front month heating oil to $1.7803/gal and up $0.0009 on front month RBOB to $1.6438/gal. The national average at the gas pump is down 15 cents from this time last month according to AAA.