With the new $60/BBL oil price cap on Russian oil exports now in place, Russia says it will not impact their production. The move did however create a bottleneck of oil tankers in Turkey as Russian oil tankers significant drop in its oil production or exports.[1]

[1] https://www.cnbc.com/2022/12/07/eu-sanctions-russian-oil-price-cap-cause-crude-tanker-bottleneck.html

Since the oil price cap, 35 tankers have left Russia, bound for destinations like Turkey, Italy, India, and Greece. Sixteen of these 35 tankers are stuck awaiting clearances. These clearances are delayed and are taking on average 47% more time to obtain, week over week. They are waiting on average 64 hours to continue their passage. Furthermore, China and Indian tankers are making a big run on Russian exports. The fleet of Chinese and Indian flagships is only expected to grow in the coming weeks as their respective refineries clash to get cheap Russian oil.

As of October, Russia had yet to find markets for an additional 1.1 million bpd of crude and 1 million bpd of diesel, naphtha, and fuel oil which will be banned in Europe by early February, the International Energy Agency (IEA) said in its Oil Market Report in November. “For crude oil, no significant buying from Russia outside China, India, and Turkey has appeared despite massive discounts.”[1]

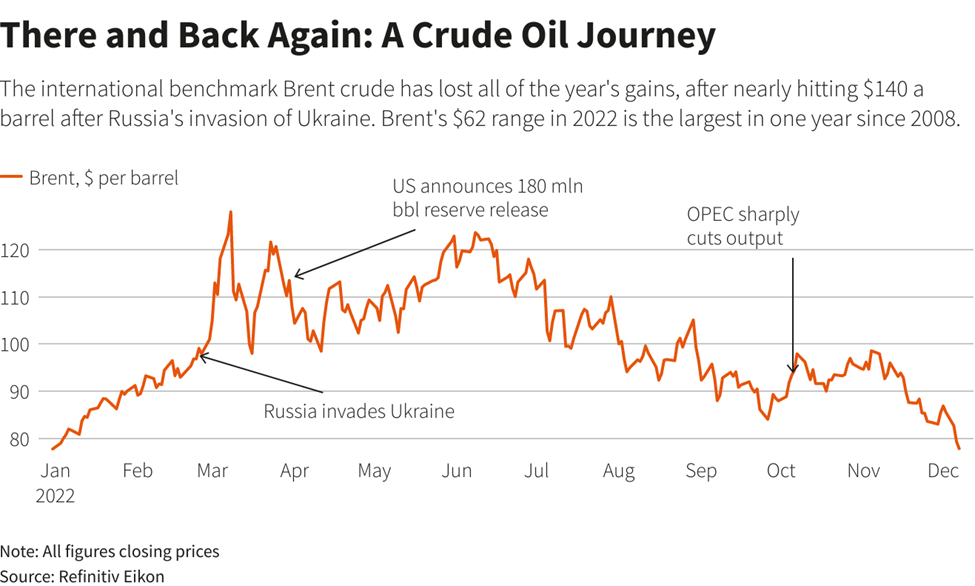

The market has already begun to react to this supply shifting. Crude has already given up all the gains it saw in 2022, including a $139/BBL price soon after Russia invaded Ukraine. This is mostly attributed to demand destruction globally. The China lock downs have curbed crude/fuel demand as much as 30-40%. In addition, Europe has suffered a relatively mild winter, further depressing fuels usage. The central reserves increased interest rates to stall a recession which has strengthened the US dollar. That strengthening has curtailed demand domestically in the US. These factors as well as many more geopolitical posturing have erased all the gains in 2022 and landed crude right back at sub $80/BBL.[2]

[1] https://oilprice.com/Energy/Energy-General/Russia-Claims-Price-Cap-Wont-Seriously-Hit-Its-Oil-Production.html

[2] https://www.reuters.com/business/energy/what-happened-2022-global-oil-rally-2022-12-08/