United States shale oil producer CrownRock has agreed to be purchased by Occidental Petroleum in a stock and cash deal valued at $12 billion dollars. CrownRock is a major privately held energy producer that operates in the Permian Basin. This deal expands Occidental Petroleum’s presence in the largest shale oilfield in the United States. The close of the deal is expected to be in the first quarter of 2024.

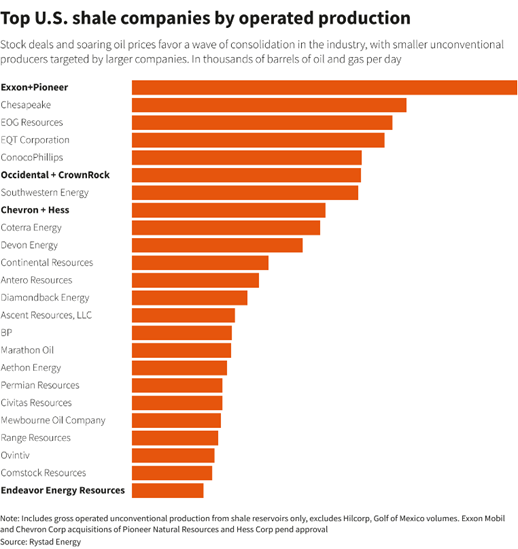

This transaction will add 170,000 barrels of oil per day to Occidental’s overall production which was at 1.22 million barrels of oil and gas per day at the close of third quarter. Occidental Petroleum is the ninth-largest energy company in the United State with a market capitalization of $49.7 billion. Once the deal is approved, the takeover of CrownRock will make Occidental Petroleum a bigger player in shale than Chevron and Hess combined.

This most recent announcement is the third major deal in the energy sector in less than two months. It was announced in October that Exxon Mobil was acquiring Pioneer Natural Resources for $60 billion dollars. A few weeks later, Chevron revealed that it had purchased Hess for $53 billion. It will be interesting to see what is next in the energy sector as it pertains to mergers and acquisitions as we head into 2024 with close to $150 billion spent in the fourth quarter of 2023.

https://www.reuters.com/markets/deals/occidental-petroleum-buy-crownrock-12-bln-deal-2023-12-11/