We’re now 13 days into the Russia-Ukraine conflict, and neither side shows signs of abating. Following this lead, neither do commodity charts. Two charts encapsulate the unprecedented of this conflict and will be contributing to the stagflation environment we are heading toward or already in. Let’s dive in.

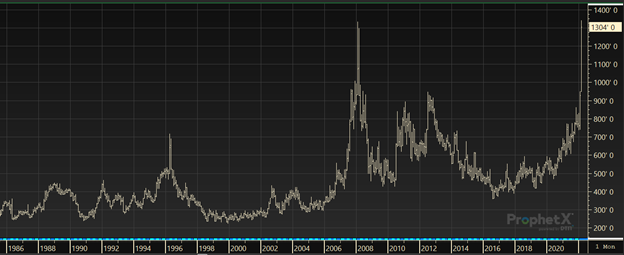

The first chart is the front month diesel crack spread. What is that? It’s the front-trading contract of diesel fuel multiplied by 42 gallons minus the price of crude oil per barrel. As you can see, just a short while ago we broke in the New Year of 2022, and it was trading just above $20/barrel. Today it is trading over $57/barrel. What this means is that if crude oil were to stay at the same level, diesel fuel is trading 88 cents higher on a relative basis than 3 months ago. Why is this happening? Yesterday, European natural gas prices hit the equivalent of $600/barrel as Russia threatens to shut off natural gas shipments to Europe. This compares to Brent crude oil which currently trades at $129/barrel. As a result, diesel fuel is in extremely high demand as a replacement fuel for natural gas at combined-cycle natural gas powerplants. This is good news for refineries because the higher the diesel crack spread is, the more money they make when cracking crude into diesel fuel.

Refineries last week in the United States were operating at 87.7% capacity to take advantage of these higher crack spreads. Over the next few months, European demand for diesel fuel is going to compete with the United States. This could keep our crack spreads propped up for longer and keep a floor on diesel prices. Diesel prices since the beginning of 2022 have risen from $2.30/gallon to $4.32/gallon at writing, an 87% increase.

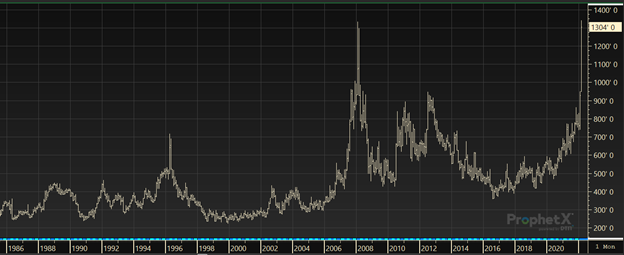

The second chart is the wheat futures contract. Why am I talking about wheat? Ukraine and Russia are responsible for about 28% of the world’s wheat exports. With Ukraine’s territory engaged in a war and Russian financial assets prevented from doing much international business, wheat prices have soared from over $700/bushel to $1300/bushel since the beginning of the year. This 85% rally in wheat prices is bound to increase food prices that the consumer will ultimately have to pay.

With the 85%+ rally in diesel and wheat prices since the start of the year, we’re entering a period of stagflation. This means that growth is slowing in inflation is growing. Global growth and demand will slow down because input costs are rising which also drives inflation up. Unfortunately, unless we get a hasty ceasefire and both Ukraine (and NATO) and Russia come to the negotiating table, the long-term effects are going to be devastating for food and energy inflation.

Natural gas prices in Europe hit an all-time high — Quartz (qz.com)

Opinion: Here’s what will happen to U.S. food prices as wheat futures keep surging – MarketWatch