This week the Biden Administration announced a plan to aid US households with $13.5B in energy bill relief. With costs expected to be 28% higher this winter, the administration is using funds from Dept. of Health and Human Services, the bi-partisan Infrastructure plan, and Emergency funding to subsidize the cost of energy to low- and moderate-income families. The move to make approximately 1.6M homes energy efficient by offering rebates is another indicator of this administrations push against natural gas.[1]

Heating energy costs are expected to rise 27% higher than 2021 and electricity is poised to be 10% more expensive in 2022. The US intends to retrofit homes, making them energy efficient, and providing rebates for energy efficient appliances, all at taxpayers’ expense. Some $4.5B in taxpayer money will be released by HHS to pay energy bills, in addition to the roughly $9B in government funding available through the Emergency and Infrastructure plans that were passed prior for the home efficiency rebate program. The plan also calls for the installation of over 500,000 heat pumps. In the US, the Northeast is most likely to fall victim to surging prices and blackouts. Is subsidizing energy costs really the way to go? The biggest answer to the energy price crisis lies less than 500 miles away.[2]

The US shale industry is ready to tackle the energy crisis. Cheap, reliable, CLEAN energy rests in the US Utica/Marcellus reservoir less than 500 miles away in the Appalachian foothills in Western Pennsylvania, Northern West Virginia, and Eastern Ohio. The roadblock to this solution, canceled pipelines.

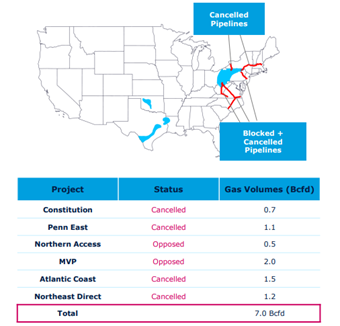

Besides being clean energy, eliminating the use of coal and heating oil, natural gas is reliable. In addition, the industry is willing to foot the cost of the infrastructure, meaning that taxpayers pay nothing to lower energy costs. Taxpayers may even gain royalties in the basin in which gas is produced and pipelines are laid. Pipelines are essential to moving the gas across the US to provide reliable and cheap energy, but anti’s have fought ferociously in the legal field to cancel and/or oppose and slow pipeline projects. Between 2021 and 2022 nearly 7Bcfd of pipeline capacity from the Appalachian Basin have been outright canceled or opposed, totaling 6 projects. The projects would have organically lowered consumer prices without government subsidization.

The real and common-sense approach to solving the winter energy crisis is simple. Making homes more energy efficient can be done in tandem with approving pipelines to supply these regions with natural gas. The US doesn’t need to be pro-clean energy and anti-natural gas. They are indeed one in the same and the icing on the cake is that the Shale industry will pay for the cost to lower energy prices.

[1] https://www.reuters.com/business/energy/biden-administration-seeks-cut-us-home-energy-bills-with-45-bln-savings-package-2022-11-02/

[2] https://www.cnbc.com/2022/11/02/biden-administration-to-provide-over-13-billion-in-aid-to-help-american-families-lower-energy-bills.html