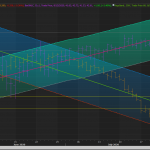

The oil complex is trading much higher this morning due to a flurry of bullish headlines: increased chances of a federal stimulus package, weaker dollar, oil strikes in Norway, and the development of Tropical Storm Delta.

Read MoreBevy of Bullish News Sends Oil Prices Higher