Ever since WTI crude oil prices broke out above the $32/barrel level in May, we have been on a steady grind higher. The question is, will this continue?

After WTI crude broke above $32/barrel in May, which is widely believed to be the average breakeven for U.S. domestic producers, prices have continued higher on a stream of good news. The OPEC+ production cuts are still in place with oil demand well off its lows as travel demand recently hit a 5 month high; the Congressional $2.3 trillion CARES Act and Federal Reserve increased Treasury and corporate debt buying kept many businesses afloat and provided additional liquidity into the economy which consumers used to help spend on their fuel; and the dollar index has sold off because more money printed and provided into the economy diminishes the value of the dollar which is bullish for commodity prices denominated in dollars.

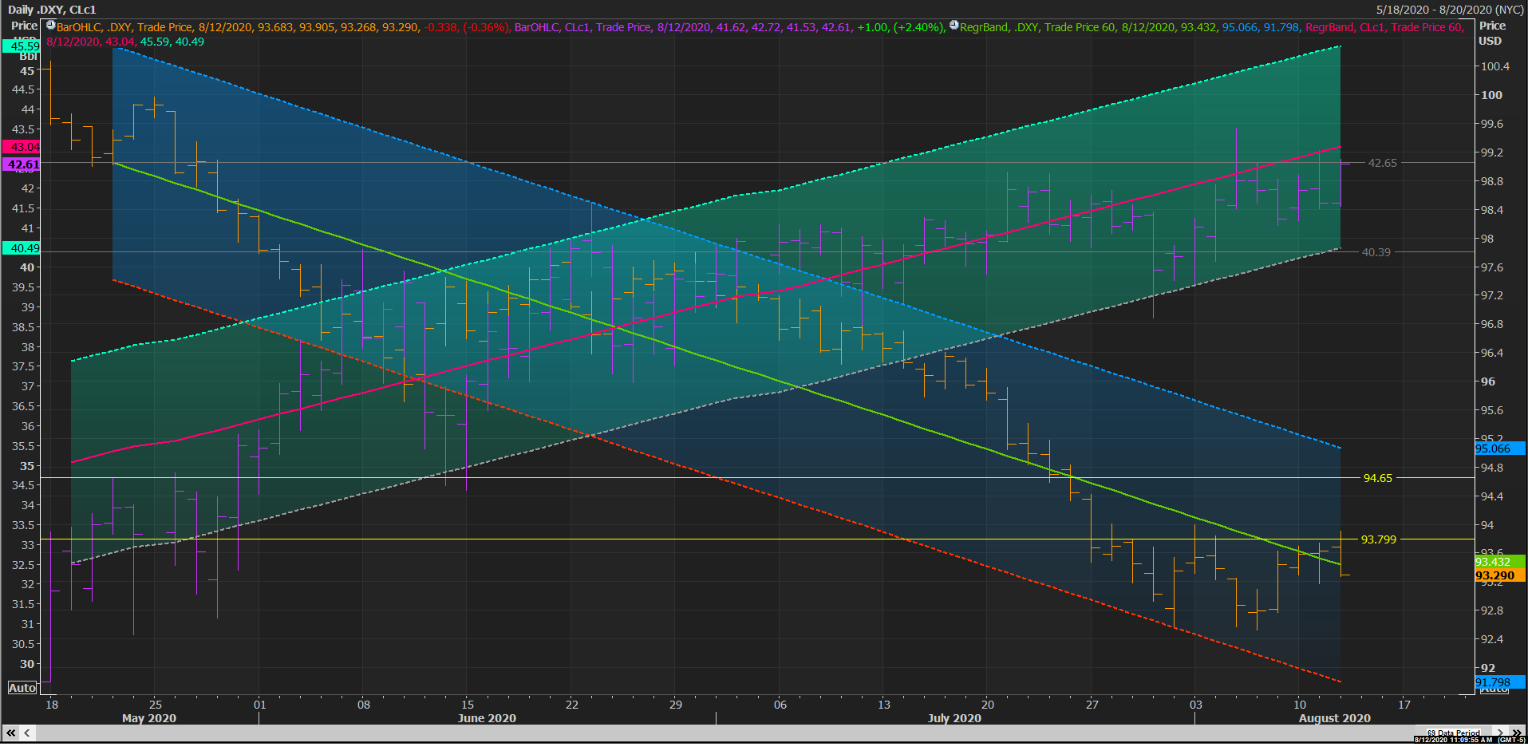

Today WTI trades at $42.37/barrel and the dollar index trades at 93.34. Keeping these two values in mind, we have to look forward to what we will encounter in the future. Most notably, that is the next stimulus package that Congress has been struggling with deciphering the price tag on. The Democrats and Republicans reportedly haven’t met since negotiations broke down Friday. That prompted a series of executive orders put forth by President Trump which include a $400 unemployment benefit (down from the $600 benefit from the CARES Act), eviction order protections, student loan payment deferral extension, and a payroll tax cut which essentially defers your federal tax withholding. The Democrats, with the most vocal discontent coming from Senate minority leader Chuck Schumer, claim these executive orders do not go far enough. They desire more money to be allocated towards COVID-19 testing and tracing, more money for school reopening’s, food assistance, aid for state and local governments, and money to ensure the elections in November can be safely executed. The executive order also challenges Congress’ “power of the purse” stipulated in the Constitution. Therefore, despite the executive order, Democrats and Republicans still need to come up with a second legislation package to follow the CARES Act. Economists believe we need it into next year when presumably a vaccine is fully developed and available to every American. There are market participants that believe once a deal is struck, the dollar index will have a relief rally. Since the dollar and oil prices are conversely correlated, a rally in the dollar index will be bearish for oil prices. Since the dollar has had a historic move lower since May, all else being equal, it could put a lid on oil prices here absent a distributable COVID-19 vaccine. Thus, we need to closely watch the progress on the stimulus negotiations to determine our next direction on oil prices.