Crude oil prices have been on a tumultuous ride for the past month, but is the worst behind us? We first learned of the Omicron variant in South Africa on Thanksgiving Day, and when financial markets re-opened on black Friday, the oil patch was terrified. As you can see in the chart above, WTI crude […]

Read MoreSky High Natural Gas Prices Not Leading to More Drilling or Production

The world is quickly approaching an energy crisis as we move into the winter season. Power generation and home heating are expected to be areas of concern and come at a price that is far higher than consumers have seen. China has already began scheduling intentional black outs. Crude and Natural Gas should/would be the […]

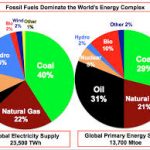

Read MoreFossil Fuels v. Renewables- The Truth, the Whole Truth, and Nothing but the Truth

In 2021, fossil fuels is a phrase that carries negative connotations. In the push for renewable energy, electric cars, ESG, and Green New Deals, the public has indulged themselves with feel-good initiatives, buzz words, and click-bait talking points without taking into consideration the real-world ramifications these plans have. There will always be a strong need […]

Read MoreDipping Into Savings

The United States Department of Energy Office of Fossil Energy announced last Friday that contracts have been awarded for the sale of crude oil from the Strategic Petroleum Reserve (SPR). The sale is for 10.1 million barrels of fuel to be sold during the fiscal year 2021. The Strategic Petroleum Reserve was established in the […]

Read MoreOPEC+ Reaches Agreement

The Organization of the Petroleum Exporting Countries (OPEC) and allies agreed yesterday to cut production of crude oil by 9.7 million barrels per day (bpd) in May and June, 7.6 million bpd July – December, and 5.6 million bpd January 2021 – April 2022. The 9.7 million bpd is roughly 10% of the global supply. […]

Read MoreSpecification Changes Are Coming But Will Prices Soften

As we head into the month of August, the New York Mercantile Exchange front month futures shifts to September. When we think of September we think of the fall and the seasonal changes to gasoline specifications. While the price spread between the expiring August contract (summer grade) and the October contract (reflecting higher reid vapor […]

Read More“Oil Buyers Club”

China and India have had considered on creating a “club” which will negotiate better prices with oil exporting countries and will be looking to import more U.S. crude oil in order to reduce OPEC’s sway. Two of the world’s largest oil importers, second and third respectfully, have exchanged senior level visits several times to discuss […]

Read MoreTrade Talks Buoy Markets, but U.S. Production Growth Looms

The U.S. and China conclude their two-day trade talks in Beijing today with President Trump tweeting this morning “Talks with China are going very well!” This tweet and word that China had their top trade official, Liu He, attend the talks early this week have boosted equity and oil markets along with it as February […]

Read MoreEveryone Needs to Talk Nice

Oil prices rose by more than 1 percent on Monday, lifted by optimism that talks could soon resolve the trade war between the United States and China, while supply cuts by major producers also supported the market.

Read More