Energy is an industry that is talked about by many, but truly only understood by few. Whether we discuss emissions, ESG, tightening supply, carbon footprints/off-sets, or record high prices that hammer working class Americans, the simple, most efficient, and cleanest answer has all along been MORE PIPELINES!

Under the Biden Administration, the Keystone XL pipeline was terminated and now the L5 pipeline is in jeopardy of suffering the same fate.[1] All across America, fossil fuel anti’s and local governments have been calling for the shutdown and permit repeals of needed pipeline infrastructure, creating a manufactured energy crisis. When pipelines get terminated and shutdown the barrels continue to move on trains and trucks. These fossil fuel intensive alternatives make for far worse conditions than passive, hidden pipelines that can transport millions of gallons of products reliably, efficiently, quickly, safely, and cleanly.

In the New England corridor of America, natural gas power plants are being supplied via shipping imports from countries like Russia and Brazil. Yes, you read that correctly. While many protest pipelines from Appalachia, a mere 300 miles away with the world’s largest natural gas fields, ships carrying imports arrive daily to fulfill New England demand. Then, when production is curtailed and new natural gas power plants are aborted, New England is forced to rely on coal and diesel to provide heat and power amid New England winters. The process could not be less efficient.[2]

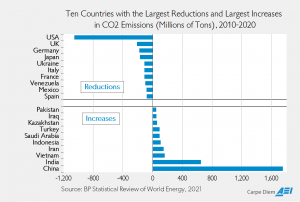

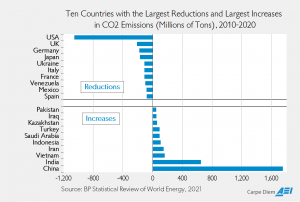

Carbon emissions, carbon footprints, and climate change are always the leading talking points anti’s stand behind when opposing new pipelines. Those very talking points are the main reasons to support new pipeline and pipeline infrastructure. Natural Gas, natural gas power plants, and pipelines are the foundation on which the USA has been able to lower its emissions and become a world leader in cleaner energy, despite exiting the Paris Climate Accord.

Lastly, record high prices that will cripple the middle class this winter and potentially cause shortages or worse…outages in the Northeast, could be 100% alleviated with pipelines. A commonsense approach to supply and demand could relieve the market and drive prices down. More pipelines mean more supply of products like gasoline, diesel, natural gas, and oil. More supply gives rise to competition and cheaper prices. Pipelines could give everyday Americans the reprieve they most desperately need from this manufactured energy crisis and historically high prices and do it more reliably and cleaner than any known alternative. MORE PIPELINES are the only solution to keeping up with Americas ever-growing energy demands.

[1] https://nypost.com/2021/11/08/biden-might-close-michigan-pipeline-white-house-admits/

[2] https://marcellusdrilling.com/2021/11/biden-dot-moves-to-kill-lng-by-rail-rule-developed-under-trump/?event=login