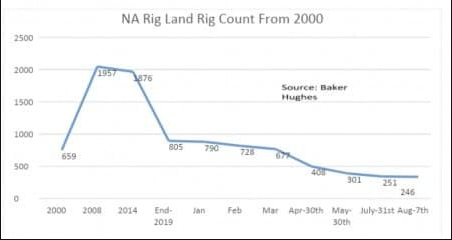

Oil and gas explorations remain sluggish and failing to rebound as expected. At $40+ a barrel and positive market indicator would historically promote conditions for the industry to recover, however there has been no indication of a recovery to speak of. The new normal seems to be a slim, budget conscious, and efficient industry soup to nuts.

OPEC+ producers holding strong on their cutback commitments, declining inventories, and positive jobless claims were certain to promote a bull market for crude. However, as a pendulum swings, there remains bearish news as well. According to EIA data, U.S. oil inventories declined by 10.6 million barrels per day during the week ending July 24th, and then dropped by 7.4 million bpd, to 4.5 million bpd, and down to just 1.6 million bpd in the three subsequent weeks, respectively. There’s a real danger that this trend could soon flip and inventories could start rising again – a very negative development for oil prices.[1] Furthermore, The U.S. Department of Labor had reported that number to be below 1M for the first time post Covid-19 until last week when they trickled back over to total 1.106M.

Cutbacks, layoffs, and capital budgets have been a painful theme for the industry in 2020. Operators have determined the new normal to be $35/barrel and have planned accordingly. Shareholders got an ugly dose of a new future that includes less production, capital, activity, footprint, work force, and a future where they plan to see $35/barrel to base economics, or less. In addition, technologies have greatly increased operator efficiency. Major service companies have committed to growing and increasing their capitals outside of the US market. Smaller service companies are experiencing bankruptcy and unable to gain steady cash flow.[2]

Overall, the market remains still and motionless. Neither bull nor bearish news is swaying the current market. Volatility remains and operators are moving forward with $35/barrel economics. Efficiencies have driven out the work force footprint and the industry presses forward with repaired balance sheets, less capital, and a slimmer look, soup to nuts.

Less operators means less production and we can look forward to a future with less supply, meaning price spikes. It seems as those thoughts may take quite some time. In the meantime, consult your Guttman sales representative to procure your fuel and beat your budget!

[1] https://oilprice.com/Energy/Energy-General/3-Reasons-Why-Oil-Prices-Wont-Rally-Anytime-Soon.html

[2] https://finance.yahoo.com/news/why-fracking-activity-hasn-t-170000695.html