Economic busts are no stranger to the energy industry. Workers have become familiar to the roller coaster ups and downs of employment in the energy sector, but is 2020 the year of a paradigm shift or is it simply another economic shock that shall soon pass?

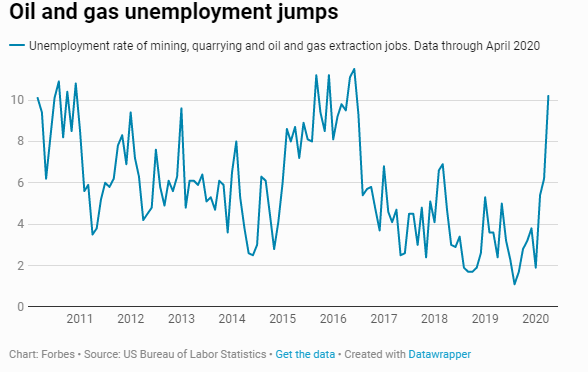

Unemployment rates in the oil and gas sector skyrocketed yet again in early 2020. Is this another economic bust that will have lasting effects like the one in the 1980’s? Historically the economy, politics and current world news have been tightly linked to crude prices and 2020 has been no exception. However, industry analysts believe the 2020 demand destruction, “… is not a speculative bust like the 1980s or 2015-16, with the price of oil falling from $110 per barrel. It is a severe, but relatively short-lived, virus-driven event.” [1]

All indications suggest that 2020 is yet another year of a short-lived market shock. Bill Gilmer, a life long analyst of crude in Texas, predicts, “prices will go back up in the fall. We have a surplus to work off, but the expectation is for oil to return to $60 or $65 a barrel by 2022.” The credit crunch of 2019 has a lot of oil and gas companies already lean and sensitive to price. This industry is not hard to jump-start and remains composed to roar back once demand begins to return.[2]

Recent studies show that America is already eager to get back out. Google maps has seen increased usage of their apps to navigate. Protests are erupting in State capitols, and states like Wisconsin opened early when their State Supreme Courts ruled Stay at Home orders unconstitutional. Recent demand has began to increase and market prices are reacting positively. Most analysts agree that as the demand increases so will the price per barrel. It will be more of a direct recovery than the long road to redemption (think of the chart as a “V”). There will always remain fear that the world demand may never fully recover and techno communication will forever hinder oil demand, but we remain optimistic that the supply will return and quickly. OPEC is cutting production by unprecedented levels. Commercial travel may lag, but the recent data suggests overall demand will return in a big way.

The industry quickly recovered in 2015 and became lean and delicate to price change. They have better financial portfolios, more easily adapt to market conditions, and reduced debt. Once the demand shock is over, these companies are poised to recover quicker than ever. 2020 seems to be nothing more than a market shock after all.

[1] https://www.forbes.com/sites/scottcarpenter/2020/05/11/americas-oil-and-gas-jobs-could-soon-come-roaring-back/#4fe2b6af10dc

[2] https://www.forbes.com/sites/scottcarpenter/2020/05/11/americas-oil-and-gas-jobs-could-soon-come-roaring-back/#4fe2b6af10dc