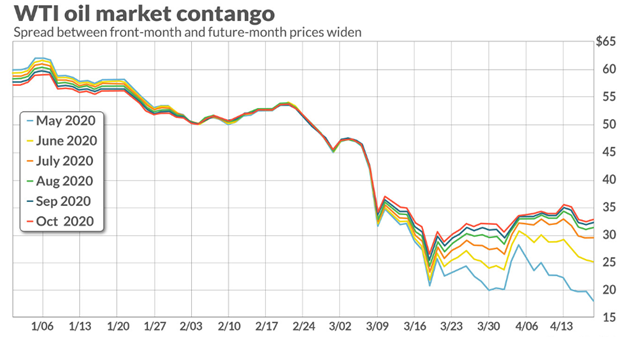

April 20, 2020 will go down in history as the first-ever negative trading day for WTI Crude as stocks plunged 321%, saw -$40.32 a barrel, and created a historic “super contango.”

For months OPEC+ was unable to reach a production cut agreement and Russia walked away from the table. On April 12, they finally decided on record high cuts that would affect the world market, but it appears to be too little, too late. The Novel Coronavirus has torpedoed demand for the commodity since late February. Most recently, the fear that storage capacities are nearing full coupled with the OPEC+ and refinery cuts, has not convinced investors that the supply glut has been addressed.

A supply surplus and steeply declining prices proved that nobody in the US wanted oil in the short term. A fear of insufficient storage and lack of demand made it near impossible to move physical barrels and the May expiring futures bottomed out.[1]

The contango between the front month and future month deliveries has caught the eye traders. This would typically encourage traders to buy and store oil. Naturally, this would be a “blood in the water” buying frenzy for traders in a historic contango. However, with an estimated 15 million barrels a day 2Q20 market surplus, OPEC+ production cuts not expected until May and June of 2020, a near full storage facility in Cushing, Oklahoma, and more “stay at home” orders for most of the Northeast, the buying frenzy hasn’t happened.

Cushing, Oklahoma continues to build at 5 million barrels a day and is currently 37 million barrels from max capacity. It will be full within two months. If your looking at a long-term investment (12 to 24 months), WTI crude would be an incredible opportunity given the super contango before us.[2]

In closing, the pandemic will pass, and supply will get turned back on. The OPEC+ and refinery cuts will start to make an impact and land-based storages will again begin to subside to an opportunistic market. If you would like to discuss your long term or short-term goals and how this “super contango” can benefit you or your company, please speak with a Guttman representative to help realize your fueling objectives.

[1] https://markets.businessinsider.com/commodities/news/us-crude-oil-wti-falls-to-21-year-low-1029106364

[2] https://www.marketwatch.com/story/oil-market-in-super-contango-underlines-storage-fears-as-coronavirus-destroys-crude-demand-2020-04-17