Tuesday, The Wyoming legislature’s Joint Minerals, Business and Economic Development Committee has sponsored a bill proposing tax relief for oil and gas companies in a bid to stimulate an increase in production. The bill, if approved, calls for tax exemption on oil production until the price of WTI reaches $45 per barrel. A year ago, Wyoming produced 102.1 million barrels of crude with 37 drilling rigs. “We’re recognizing that if [the] price is too low, companies are not going to come back anyway. So, we’re gonna set it at maybe a break-even to get a company over the hump to choose Wyoming over North Dakota, to choose Wyoming over New Mexico,” said the president of the Petroleum Association of Wyoming, Pete Obermueller, as quoted by Wyoming Public Media.

The bill, if passed, would cut the state’s mineral tax rate from 6% to 3% when oil and gas prices land above certain prices. The tax break only kicks in if the 12-month rolling average of oil prices falls below $50 per barrel, above today’s prices. For natural gas, the 12-month rolling average would need to be less than $2.95 per thousand cubic feet. Just last Friday, the rig count in Wyoming fell from 30 rigs in March to one lonely natural gas rig.

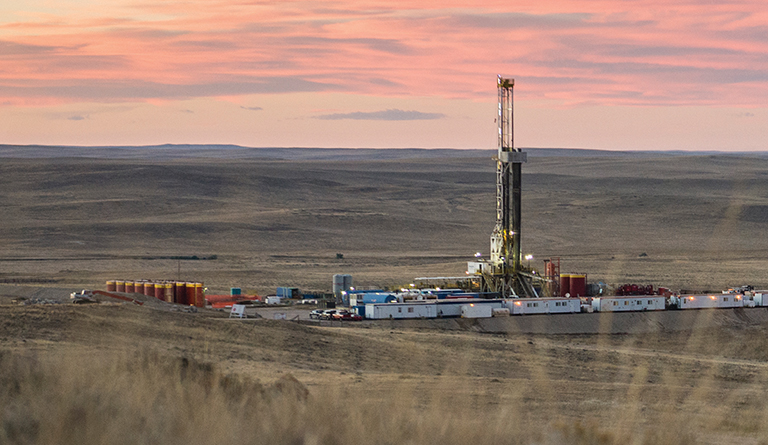

Although not one of the larger producers in the United States, Wyoming is headlined by the Powder River Basin. Running from Southeast Montana to Northeast Wyoming, the Powder River Basin appeals to companies looking for low land prices. Just three years ago, the PRB was the next big thing. Expected as the new Permian (which didn’t happen), this new tax relief may encourage drillers to take another look.

https://oilprice.com/Energy/Crude-Oil/The-Next-Big-US-Shale-Play.html

%MCEPASTEBIN%