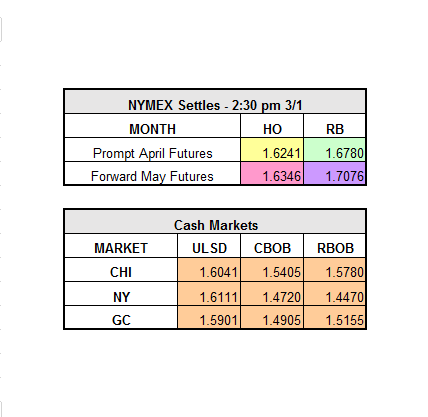

As we enter the home stretch of the week, the April HO Contract closed down $0.0158 at $1.6241/gal and April RBOB Contract at $1.6780/gal, closing down $0.0514 from yesterday. As of 11:30 a.m. ET the market is continuing its slide in the refined products. April HO is trading at $1.5912/gallon and front month RBOB at $1.6429/gallon.

According to the U.S. Petroleum Report, the bearish crude and bullish gasoline and distillate stats are right on track for refinery maintenance season. Crude production and inventory levels are continuing to rise and are still setting new records. Crude storage levels have hit a new high at 520.2 million bbl as of last week. Nationally, inventory crude levels rose by 1.5 million bbl for the week through February 24th. This came as a surprise because analysts were expecting crude to double this amount at 3.1 million bbl. We see a high turnaround for refineries during this time of year for transition season into the lower RVP gas. Turnaround for transition to lower RVP gas has begun as Midwest refineries go offline.

The weather seems to be playing a major factor in the Midwest and Northeast over the past few weeks. With 70 degree weather one day and 30 degree temperatures the next, the Heating Oil season has been unpredictable and looks like March will not be much different than February. This has probably been a factor in the recent refinery issues in the Midwest. Locally, the weather is predicted to range from the low 30’s to the mid 50’s this weekend.