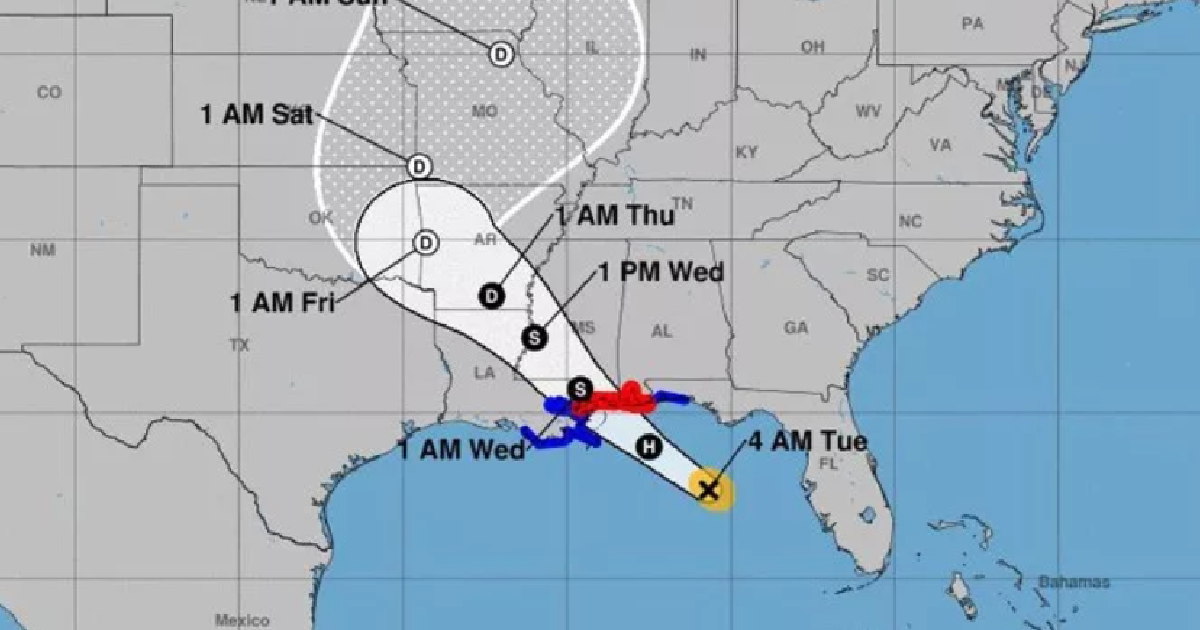

The Gulf Coast is being battered by strong winds and heavy rains courtesy of Tropical Storm Gordon, which hit the Louisiana-Alabama-Mississippi coastline Tuesday night. As the storm approached land, the winds increased speeds and threatened to be categorized as a fully-fledged hurricane. Meteorologists are predicting up to 1 foot of rain and inland flooding from Mississippi to Arkansas.

In addition to the direct weather effects, Gordon is causing disruption in the oil markets. The Gulf Coast is home to a number of oil rigs as well as important ports for the import and export of crude. On Monday, Anadarko Petroleum evacuated and shut down production at two oil platforms in advance of the oncoming storm. This was yet another tightening of the strings binding the global oil market.

The futures market is seeing a divergence as natural gas and oil futures move in different directions. On Tuesday, natural gas futures were down as much as 9.8 cents and trading at $2.818 per million BTU. Crude futures where rising to the tune of up to 2.3% from Friday’s close. There is a cocktail of factors to take into account when looking at crude prices. A generous pour of Iranian sanctions is reducing their exports, with a dash of Libyan strife all shaken (not stirred) by Venezuela’s seemingly endless crises are resulting in a market that appears seemingly bullish heading into the fall.

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iJr38pEdJpR0/v2/775x-1.png

https://www.bloomberg.com/news/articles/2018-09-04/storm-menacing-gulf-coast-pushes-oil-gas-in-opposite-directions