The oil patch traded as a mixed bag Tuesday as traders await Wednesday inventory data and a highly anticipated interest rate hike from the FOMC.

The entire oil complex initially moved lower Tuesday morning as OPEC’s reported production in May increased 336,000 barrels per day month on month. The majority of the increases came from Libya and Nigeria, which are both exempt from the OPEC production cuts.

We started receiving indications throughout the morning of inventory guesses for tomorrow’s DOE report, which was also contributing to the mixed trading. A poll by Reuters is expecting crude inventory to draw 3mb, gasoline to fall 0.800mb, and distillate to rise 0.500mb. Genscape reported yesterday that it expects crude in the Cushing hub to fall 1.8mb. These crude draws are somewhat seasonal, but the market traded higher as the session proceeded.

In addition to the inventory report tomorrow, we also look forward to the FOMC rate hike decision. The almost unanimous consensus is still that the FED will increase interest rates by another .25%. This is bullish for the dollar index, which could further pressure crude prices.

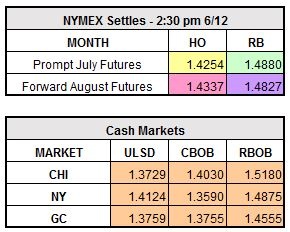

July WTI crude is up $0.24 to $46.32/barrel, RBOB is higher by $0.0044 to $1.4924/gallon, and ULSD is up $0.0193 to $1.4447/gallon.