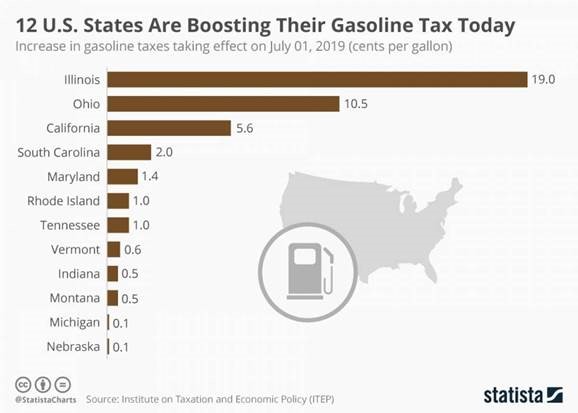

Every year on July 1st, new state fuel excise taxes are ushered in and yesterday was no different. The chart below lists the increases sorted by highest to lowest. Keep in mind this is on top of the existing state tax. Federal tax is $0.1840 per gallon. This year’s winner is Illinois with a whopping $0.19 per gallon increase. Illinois is one of seven states where drivers pay layers of both general sales tax and special excise tax on gasoline at the state and local levels. Those multiple layers mean drivers filling up in Chicago, for example, will pay $0.96 in taxes and fees on a $2.46 gallon of gasoline which equal a tax burden of 39%. The new Illinois taxes are ear marked for an aggressive infrastructure plan. To be fair, Illinois hasn’t raised the gas tax since 1990.

With all the scrutiny surrounding petroleum prices, people not in the industry tend to forget about the taxes in the price. Even with the high percent of tax it’s easy to forget how reasonable gasoline really is. Here are some fun comparisons below:

- Gallon of retail 87 grade gas on average in California = $3.98

- Gallon of Milk = $3.19

- Gallon of Clorox Bleach = $2.54

- Gallon of Fiji Water = $10.24

- Gallon of Guinness = $64.00

- Gallon of Olive Oil = $60.14

So, when you’re filling up for the holiday and you feel prices are too high, remember, the tax and then think about how reasonable the product price really is.