As 2019 begins, U.S. liquefied natural gas is anticipating the most significant year of exports ever. “The U.S. is poised to triple export capacity to around 10 Bcf/d by the end of next year, and we could be on our way to be the world's largest exporter before 2025.”[1] Mexico and South Korea are currently the largest imports of U.S. natural gas accounting for nearly 40% of U.S. exports, but the demand is impacting the entire globe. China, while currently imposing a 10% tariff on the product, also shows high demand. As U.S. production booms, the rest of the world is watching its supply capabilities.

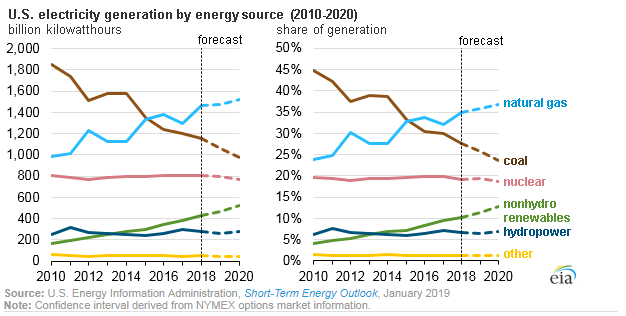

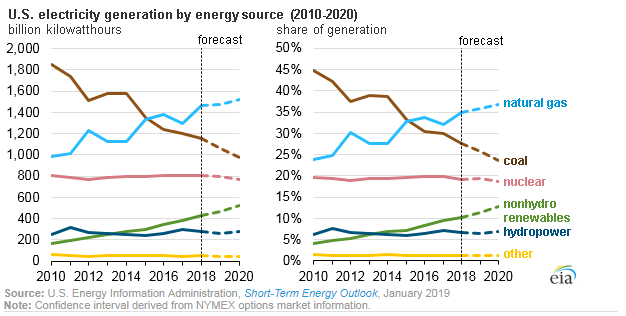

The EIA’s outlook below only reports through 2020, but the investment in natural gas powered plants encourages growth for many years.

Domestically, as natural gas prices remain low, the power generation market has begun to phase out the use of coal and nuclear options. Coal found in the Appalachian region was the major power generating source for decades but demand is shifting in favor of natural gas. The region’s economy has produced a visible shift to the amount of drilling activity. “This trend seems irreversible considering regulations that encourage clean power and the way in which gas complements renewables. Regardless of policies, the relatively low gas price environment generally discourages additional investment to upgrade or further limit emissions from coal plants, especially considering the threat of federal carbon control that still looms on the horizon.”[2] As domestic and global demand soar, a focus has been on how to efficiently get the product to consumers.

The U.S. still needs to invest in transportation of the natural gas so that it is able to reach across the entire country as well as globally. “CAPEX for natural gas infrastructure totals $417 billion, equating to 52.7 percent of the total investment in new infrastructure throughout the projection. Much of the investment in gas infrastructure, or $279 billion, is in gas gathering and transmission systems. The most intensive capital expenditures for natural gas infrastructure occur to gather and transport Marcellus and Utica as well as Permian Basin supplies to markets.”[3] As 2019 accelerates the shift in power to natural gas, the investment in energy infrastructure will have a positive impact on the economy.

[1] https://www.forbes.com/sites/judeclemente/2018/11/23/u-s-liquefied-natural-gas-poised-for-biggest-year-ever/#177f62b716cb