There appears to be a lot of uncertainty within the oil market right now. Of note right now in the market is the reduction of net long positions over the past three weeks.

- Nearly 161 million barrels worth of long positions have been exited, taking it down to 389 million barrels, a level not seen since August 9th, 2016

- Heating oil hedge funds have a net short position of 27 million barrels

- Gasoline has hit close to the record for a net short position of 21 million barrels

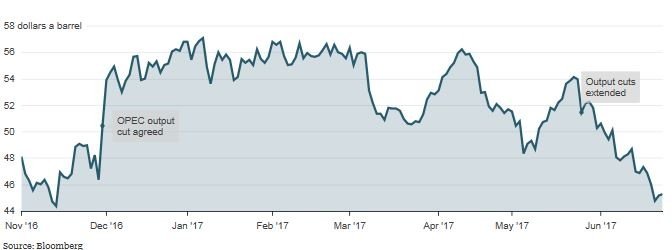

How did all of this happen the past three weeks? It all started with the belief by many that OPEC could rebalance the market with its production cuts. When the OPEC cuts were decided, there was an accumulation of nearly 1 billion barrels worth of net long positions documented. Since then there have been three sell-offs in the market, resulting in many fund managers facing large losses in 2017. After this, though, there was a change in strategy amongst the traders.

We are now seeing fund managers add (Since June 6th):

- 77 million barrels in short positions in WTI

- 59 million barrels in short positions in Brent.

According to Reuters, “Hedge funds have added short positions faster and more aggressively than during any previous short-selling cycle in the last three years.” We are seeing short positions taking over the market and reaching the highest levels since August 2016 within Brent and WTI. This could be the traders doubling-down and trying to make their money back on the short side which they lost on the long side. If this is the case, we could see a sharp reversal higher if bullish news enters the market. We haven’t really seen any bullish news as of late, and are about due.

Most times this amount of bearish news forces a reversal in the market and causes prices to rise. BUT, given the amount of continued production within the United States, Nigeria, Libya and Iran, the reversal in the market is being snubbed for the time being. The stats show significant production coming out of these countries:

- United States records its 23rd week in the row in rig increases (11 new rigs this past week)

- Libya has hit 900,000 bpd and plans to increase production to 1.32 mbpd by the end of 2017

- Nigeria is looking to increase production to nearly 2 mbpd (similar levels seen prior to militant attacks in 2016)

- Iran’s oil minister has announced that the OPEC country has surpassed 3.8 mbpd

So where are all the bulls with their bullish news to help their cause? Well we have only seen a few signs of them recently. First was the attacks on the pipelines in Colombia and secondly was the United States hurricane season beginning. PVM has reported that “USGC production has been shut in last week and crude oil imports have also been affected.” This should ultimately drop both crude inventories and oil imports come Wednesday when EIA releases their weekly report.