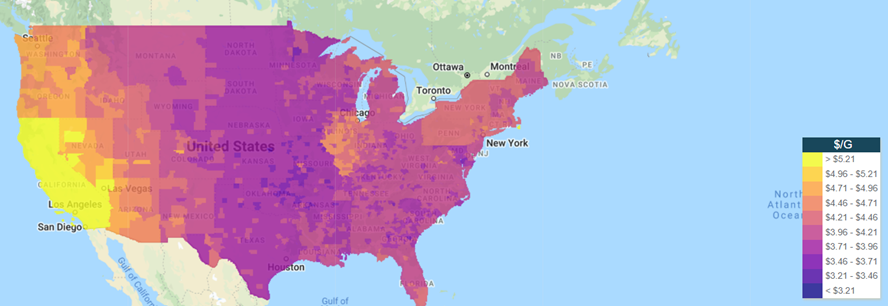

Fuel prices across the world are continuing to climb to record highs amid the Russian-Ukraine conflict. People across the world are experiencing the economic hardships as a result of astronomical prices and are looking for answers as to why they continue to climb. According to AAA, the average price of gas across the U.S. is $4.23 per gallon. Just last year, the average price was around $2.87 per gallon. Similarly, diesel prices have exceeded $5 per gallon. Although prices dropped slightly earlier this week, experts say there is no clear end in sight. In fact, prices are expected to rise as we approach the summer months accompanied by growing demand. There are reasons behind the madness, but could there be any solution to alleviate the pain?

What Is Influencing Gas Prices?

Several key factors are influencing the price of gas and diesel across the world. The first reason is that post-pandemic demand has reached pre-pandemic levels as businesses have reopened and mask mandates have been lifted. The second factor is that oil production–having slowed during the pandemic–hasn’t been able to keep up with record-high demand. Slowly, refiners are beginning to ramp up production, but it’s still not enough. On top of that, the Russian-Ukraine conflict has caused prices to skyrocket and become more volatile than ever before.

The Impact of Russia’s Invasion into Ukraine

The spike in the price of gas in the U.S. became significant amid the Russian invasion into Ukraine. Since Russia’s invasion, gas prices have increased by 17%. On March 8, President Biden imposed a ban on Russian oil and gas imports. The sanctions have disrupted the global market and influenced prices heavily. Following the United States’ ban on imports, the European Union’s leaders began debating on their own sanctions against Russia. Although the U.S. doesn’t rely heavily on Russian oil imports, the European Union does. Many lawmakers in Europe have hesitated about imposing sanctions on oil, but others are adamant that contributing to Russia’s economy is adding fuel to the fire and will negatively impact the people of Ukraine. If the European Union decides to sanction Russian oil, it’s possible that we may see an even bigger jump in price.

Is There Any Solution?

Recently, lawmakers in the U.S. have proposed a gas rebate to Americans that would be sent out once a month when prices hit $4 per gallon. Other representatives in California have suggested raising taxes on major oil-producing companies and issuing checks or debit cards to residents that have cars registered in the state. Maryland and Georgia have temporarily halted gas tax, and other legislation has been proposed to suspend federal gas taxes. Consequently, others have voted against the proposed legislation because it takes away from federally funded infrastructure.

While proposed legislation for gas rebates and tax withholdings would help consumers at the pump, it may hurt the economy and further contribute to rising inflation. Delayed oil production, high demand, and the war in Ukraine are all factors that are contributing to the high and volatile prices we are seeing daily. Ending the war and ramping up production in the U.S. could alleviate the pain, but according to experts, there are no answers just yet.