The market rebounded this morning and is continuing to remain strong after a weaker U.S. dollar, which is down $.0120 to $96.42 today. Another factor that is adding to the bullish market is the continued conflict in Nigeria, after the NDA (Niger Delta Avengers) blew up the Qua Iboe crude oil terminal operated by ExxonMobil late last night. The Qua Iboe is Nigeria’s largest crude oil terminal, exporting over 300,000 barrels a day. Whenever there is a supply disruption of any sort, it is common for the market to react abruptly and if it heavily affects supply, the market should continue to rise (as witnessed with the Canadian wildfires back in May).

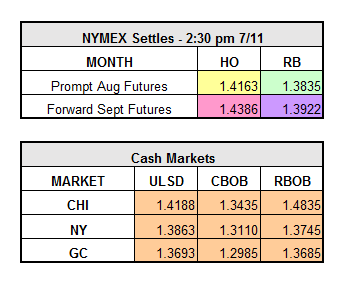

Diesel reached as high as $1.4707 on the NYMEX today, but as of 11:15 a.m. it is up $.0337 to $1.4500. Gas followed in the footsteps of diesel, reaching $1.4406 but as of 11:15 AM it is up $.0432 to 1.4267. Crude, on the other hand, has remained strong, currently up $1.27 and sitting at $46.04 on the day. The DOE report is estimated to show yet another draw when it is released tomorrow morning at 10:30 a.m. EST. The draw should be around 3.3 million barrels. The API report will be released this afternoon at 4:30 p.m. EST and lately there has been an inconsistency between the API’s and DOE’s which creates a question mark on what to follow.

Let’s recap news that could sway the market either which way. On the bearish side, we have rising U.S. oil rig counts, improvements in Libyan supply, Brexit news, and a stronger dollar. Bullish influences include supply disruptions, geopolitical unrest, Brexit news/uncertainty of the European economy, and possible OPEC announcements regarding the need for crude to exceed $50 again to sustain investment.

Interesting news:

- OPEC sees 2017 global oil demand growth at 1.15 mbpd, calls on its oil to rise by 1 mbpd.

- The U.S. dollar was receiving further support since Brexit, as England debated cutting interest rates, but has fallen off today, down $.0120.

- Chinese oil consumption to rise to 670 million tonnes by 2027 at an annual growth rate of 2% and its annual oil output to increase to 230 million tonnes by 2030.