As the market continues to increase higher on crude, let us take a look back at February to discuss highs and lows. The low of the entire month was on February 11th, when crude fell to $26.05 a barrel. On that same day, crude reached a high of $27.48. Two weeks later crude hit a high of the month of $34.69. February brought a ton of market movements, but stuck in a range of $26-$34. Now for March.

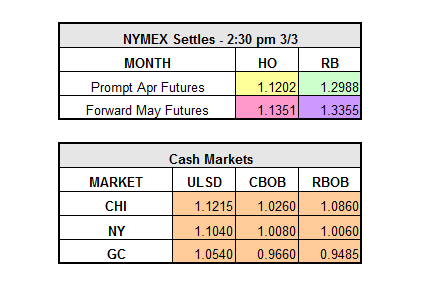

We have had higher highs on crude every day since the start of the month, and now it is at a high of $35.94 as of noon ET. Why the surge today? The U.S. Dollar was strong at the beginning of the day, but now has fallen to 97.290, down -.311 after the U.S. employment report showed a large increase in nonfarm payrolls. Diesel is up $.04, gas is + $.0350, and crude is + $1.20 today as we head into the latter half of the day. One of the trading houses we work with had an interesting take on WTI crude: “WTI crude has mixed signals with a long term lower objective to $18.00, a short term higher objective to $ 43.00 and a very short term higher objective to $37.00. WTI has been range bound and it is the breakout of this range that will determine its next big price move. A trade of $37 will remove the long term lower objective and give a new long term higher objective of $53.00 – but a breakout lower with a trade of $28 will give a new long term lower objective all the way to $6.00.”

World News:

- No time or date has been set for non-OPEC/OPEC producer meeting. Although, Russia’s energy minister has proposed that oil talks be held in Vienna between March 20 and April 1.

- Oil industry investment spending was cut over $100 billion last year reported by IEA.

- Credit Suisse sees the potential of crude jumping to $50/bbl in May.

- Chinese economy faces greater difficulties in 2016.