How the Time of Year Can Affect How You Fuel Up

A large part of Fueling Intelligence is understanding the differences in seasonal fuel grades, gasoline production and price. Depending on the month of the year, your gasoline is configured differently. Different blends are used to account for differences in weather conditions and temperatures. Basically, this means that a winter fuel blend allows for more evaporation, letting your engine start better in cold months, and summer blend allows for less evaporation, leading to less smog.

These differences in fuel composition also mean differences in processing and, consequently, differences in price. The complexities of making summer blend fuel add about 15 cents per gallon onto the price compared to winter-blend fuels. We’re breaking down the industry insight into the cycle so that you can see just how the market works for—or against—you when it comes to purchasing your fuel.

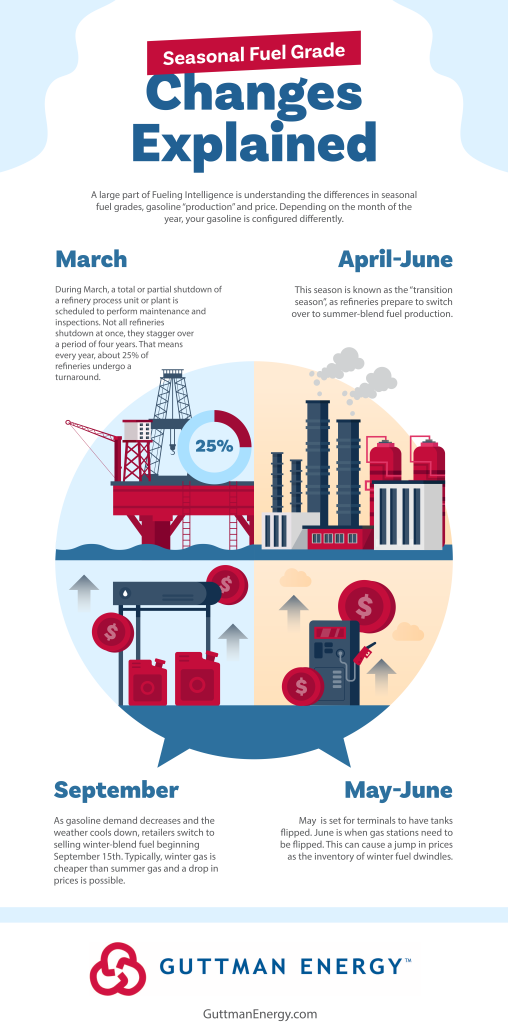

February

During February, a total or partial shutdown of a refinery process unit or plant is scheduled to perform maintenance and inspections. Not all refineries shutdown at once, they stagger over a period of four years. That means every year, about 25% of refineries undergo a turnaround.

March-April

This season is known as the “transition season”, as refineries prepare to switch over to summer-blend fuel production.

May-June

May 1 is the compliance deadline for systems to get rid of winter-blend fuel. Because of this, this can cause a jump in prices as the inventory of winter fuel dwindles. Never fear, however, because most terminals have their summer blend fuel in their storage facilities by this date as well. At the latest, retailers have until June 1 to switch to summer-grade fuel. However, from a fuel buying standpoint, these deadlines of seasonal gas prices tend to peak in May.

September

As gasoline demand decreases and the weather cools down, retailers switch to selling winter-blend fuel beginning September 15. This switchover can also result in a short spike in fuel prices.

The winter fuel change is not required, so some retailers wait until their inventories are low to make the switch over, whether it is before or after September 15. As well, even though it is optional, many retailers will choose to sell winter blend because it is cheaper. Therefore, by the end of September, gas prices generally decrease.

What Does This Mean for Your Fuel?This shows why Guttman Energy’s market intelligence is so important. By knowing seasonal fuel grades, when to buy and when to have extra fuel on hand, you can avoid shortages, and always have the best value, no matter the season. For more information on Guttman Energy’s pricing programs, operability programs and fuel inventory management solutions, contact a rep at 724.489.5199.