TRADE WARS! TANKER GATE! IRANIAN SANCTIONS! MIDDLE EAST UNSTABLE! MIDDLE EAST PEACE! VENEZUELA SANCTIONS! INVENTORIES UP! INVENTORIES DOWN! REFINERY OUTAGES! PRODUCTION DOWN! PRODUCTION UP! CRUDE CHASES $50!

CRUDE RUNS UP TO $60!

WHAT DOES IT ALL MEAN?

It means extreme price volatility in the oil market making it difficult to run your business. Whether you’re a refiner, wholesale marketer, distributor, retailer or end user the price volatility is making your job harder. Let’s look at gasoline volatility.

On July 31st gasoline the intraday high traded at $1.8470. Yesterday, the intraday low was $1.6107 representing a $0.2363 price decline. These types of price moves help lower retail gasoline prices except extreme price volatility holds back retail prices. An example is news driven days like August 7th to August 12th prices actually rose over $0.12 per gallon.

With lower price RVP gasoline on the way we should see the seasonality of the business take over and show us the best gasoline prices of the year. However the extreme volatility makes that hard to predict.

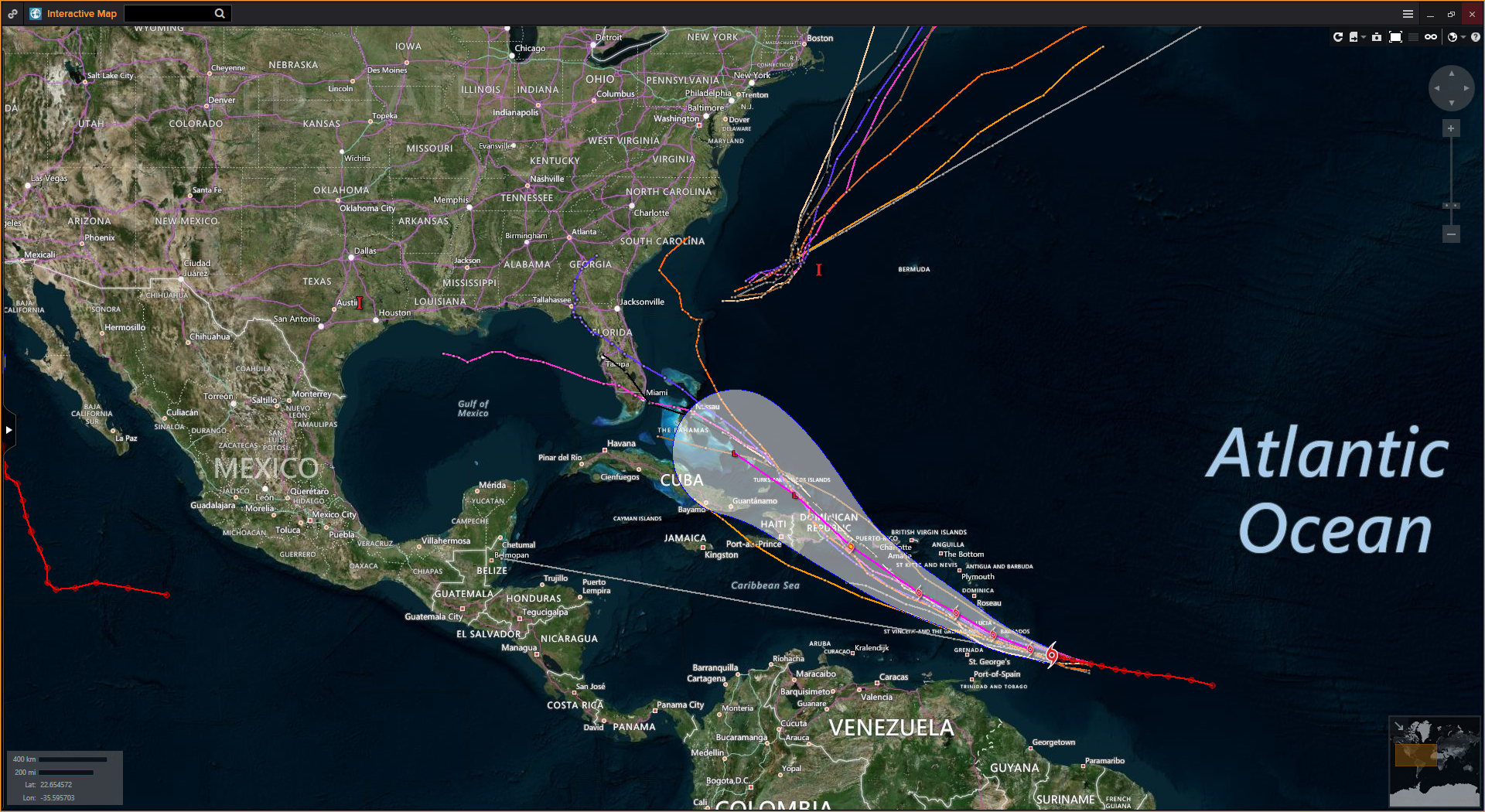

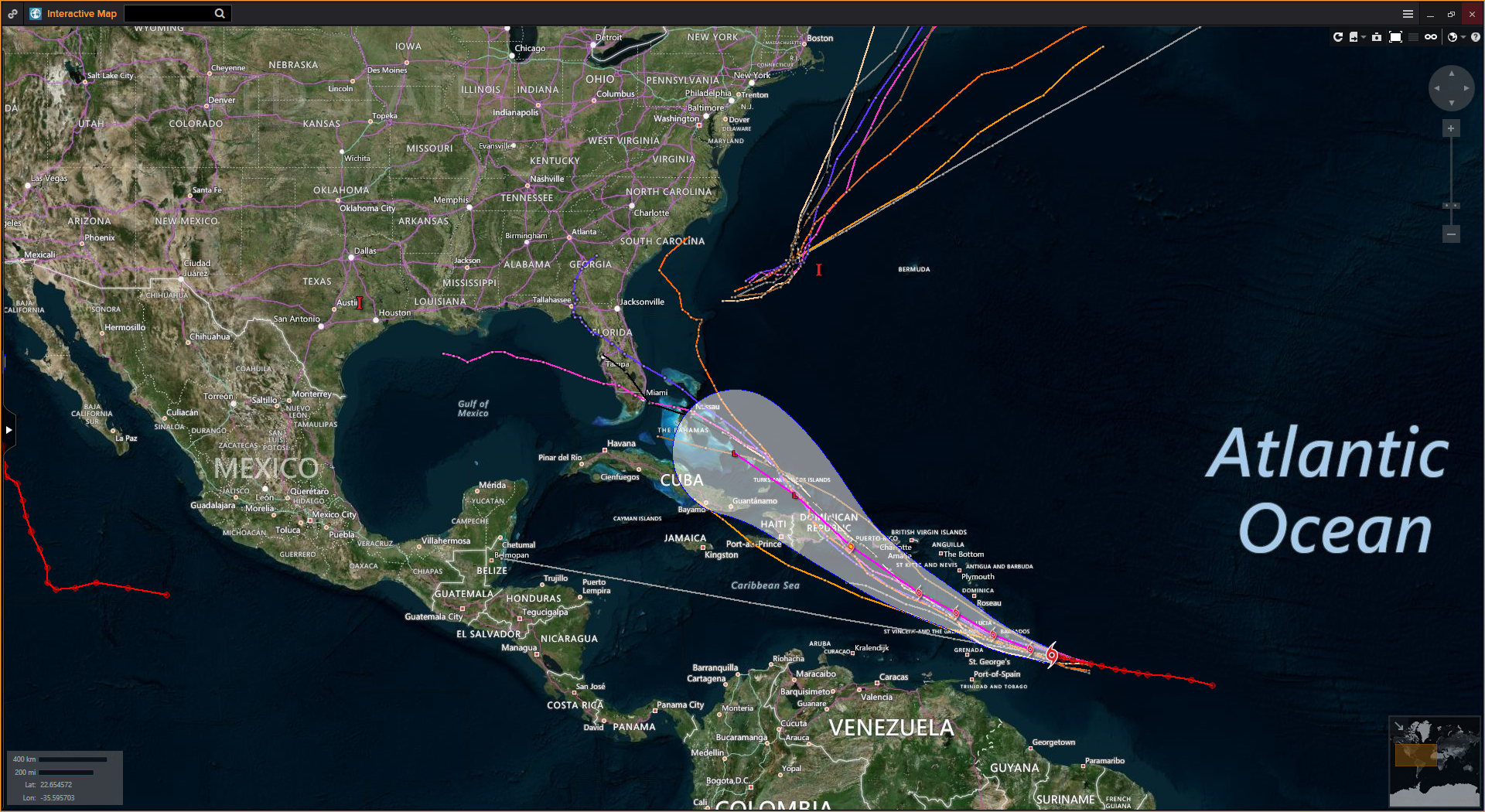

And there’s potential for a huge disruptive force out there.