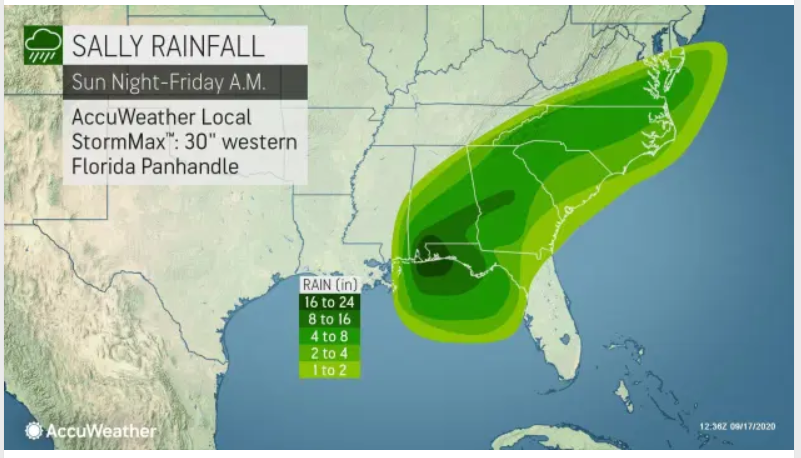

The oil patch is rallying today being led by refined products. This is due to the fact that Hurricane Sally has left a trail of “catastrophic” rainfall in Alabama earlier this week and is now barreling through the Carolinas and is hindering supply at petroleum terminals.

Despite Sally making landfall as a Category 2 Hurricane early Wednesday morning, the system is still churning through the southeastern United States and causing severe flooding with its high rainfall totals impacting fuel supply reliability. Petroleum terminals as far north as Charlotte, NC were running on fumes last night as diesel demand outweighed supply as folks rush to prepare for the clean-up that will ensue once Sally edges more northeast. The concern from the fuel perspective is the extent to which rivers and roads flood and how long the floodwaters will remain. If the floodwaters surround petroleum terminals or idle the pipeline pumping stations, fuel supply could be hindered further once the storm passes. As of right now, there is little demand as many drivers are off the road and clean-up crews aren’t working at their full capacity yet, but we will know more over the next few days if fuel supply constraints will persist.

NYMEX diesel prices are up the most today trading at $1.1628/gallon, up by $0.0465/gallon. This comes a day after the Department of Energy reported a weekly build in distillate stocks of 3.5 million barrels. Diesel inventories are above their normal averages, especially with limited jet fuel demand persisting due to COVID-19. However, the diesel prices relative to crude oil prices are so low that some market participants believe the ratio is too low which has been not been incentivizing refineries to produce distillates. It appears that trend is reversing, at least for today, with WTI crude oil trading higher only by $0.95/barrel to $41.11/barrel. Meaning that the diesel crack spread is enjoying about a $1.00/barrel gain today. NYMEX RBOB currently trades higher by $0.0377 to $1.2266/gallon.