Although not so substantial, the market has indeed been in rally mode for the majority of the morning with WTI crude up $0.29 to $44.36. As for refined products; RBOB is trading down $0.0191 and ULSD is up $0.0032. Numerous events and topics world-wide could be influencing the market to behave as such.

- WTI prices this morning may be prompted by a stock surge as the Dow rose 300 points. This may be a combination of the nearing of the U.S. Election Day (tomorrow) as well as the FBI clearing Hilary Clinton, stating that her emails and use of a private server was not a crime.

- This further solidifies the mentality that Hillary Clinton winning the presidency would be good for the stock market, while the election of Donald Trump would be bad for stocks.

- This pre-election soiree has also bolstered the U.S. dollar index, which is up $0.43 at post time. This is quite interesting because as mentioned time and time-again the U.S. dollar and WTI crude market are inversely related.

- Last Friday the Baker Hughes Rig Count report showed an increase of 9 rigs last week, bringing total U.S. oil rigs to 450.

- OPEC’s Secretary General, Mohammed Barkindo, has gone on record this weekend stating that Russia is “on board” with an OPEC agreement to limit crude oil production. He also declared that all OPEC members are “committed to the Algiers accord” and will uphold the decision to formulate a plan to limit oil production.

- Additionally, Saudi Arabia has not threatened to increase its production if other OPEC members do not agree to proposed cuts and limitations.

- Colonial Pipeline resumed activity in its gasoline line, Line 1, yesterday morning, slightly ahead of schedule. Line 1 was down for six days following a fatal explosion.

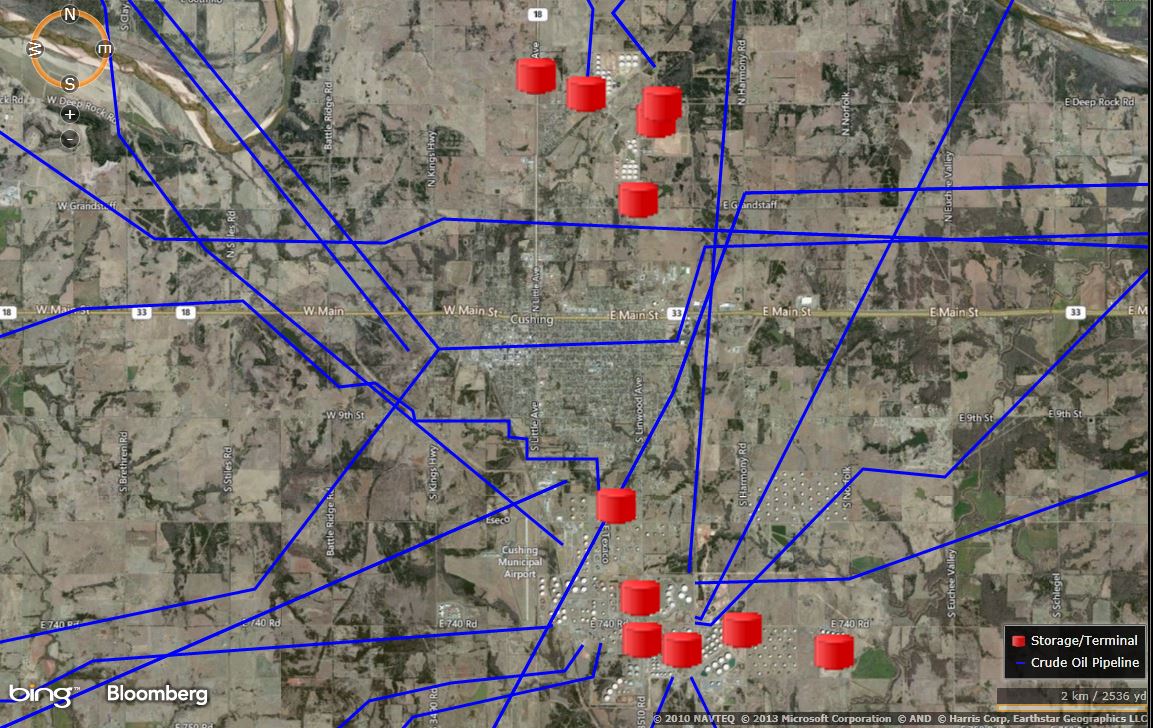

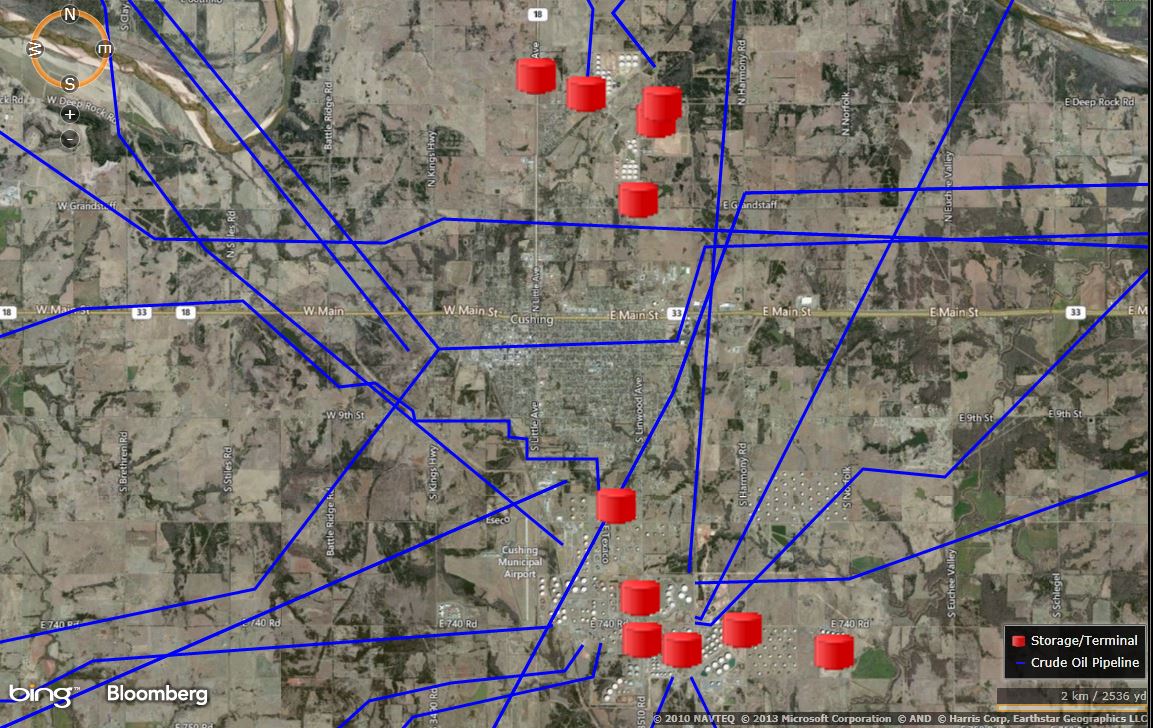

Cushing, Oklahoma is home to the world’s largest oil storage facility, known as “The Cushing Tank Farm.” There are currently 13 pipelines that bring crude oil into Cushing, and 12 pipelines going out. It is estimated that the Cushing Tank Farm can hold roughly 46.5 million bbls of oil. Why am I telling you this? Well, just this past weekend there was a magnitude 5 earthquake less than 2 miles away from Cushing. Several pipeline companies took the necessary precautions to shut down operations, however, there have been no reports that any pipelines or other assets have been jeopardized at this time. Cushing, Oklahoma is not only the physical delivery point for West Texas Intermediate (WTI Crude), but also a pricing location for the NYMEX futures market.