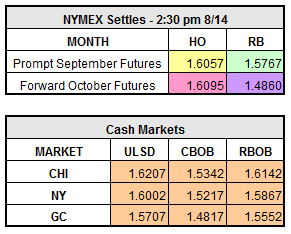

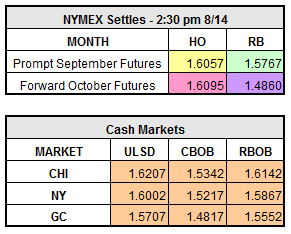

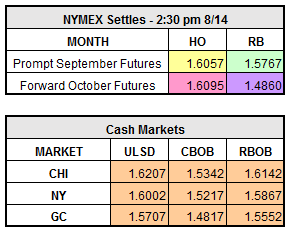

The oil market fell sharply on Monday closing at three week lows as continued rising crude output from OPEC members and U.S. shale oil producers continue to be the prevalent theme. September crude settled down $1.23 to close at $47.59 / barrel while heating oil and RBOB also closed down substantially finishing the session at $1.6057 / gallon and $1.5767 / gallon respectively.

Losses grew throughout yesterday’s session after a report from the U.S. Energy Information Administration was released which is anticipating a monthly rise in domestic shale-oil output. “U.S. production remains the single biggest headwind for the oil market right now, and until we begin to see signs that domestic output growth is fading, WTI will have a very hard time rallying through the $50 mark in the absence of an unrelated bullish catalyst” said the editor of the Sevens Report. Monday’s EIA report stated it expects September shale oil output to grow by 117,000 barrels per day to 6.149 million barrels per day. The report has shown an increase in shale-oil production every month in 2017. “This is not the report that OPEC wanted to see” said an energy economist for WTRG Economics. Another bearish point contributing to the downward pressure are questions being raised regarding China’s demand as Chinese refining rates are at their lowest levels since September of 2016 coupled with higher inventory levels.

This morning all oil market indices are down as the dollar is up slightly due to easing of U.S. – North Korean tensions and strong economic data. Later this afternoon, the American Petroleum Institute will release its weekly data with the EIA data following tomorrow morning. Early EIA projections have draws on crude (-3.176 mill bbls), gasoline stocks (-1.527 mill bbls) and distillates (-.620 mill bbls).