Oil prices are relatively flat this morning as the latest API data from last night showed a build in crude stockpiles of 3.1 million barrels, coupled with a draw in Cushing. The DOE just reported this morning a build of over two million barrels, with draws in both gasoline and distillates.

With most of the current news centered around last weekend’s OPEC meeting in Doha, described as a “flop” by one analyst, the resolved Kuwaiti oil workers’ strike and the continued market oversupply, I thought it would be interesting to compare where the settles are now versus where they were exactly one year ago.

April 19, 2015 vs. April 19, 2016:

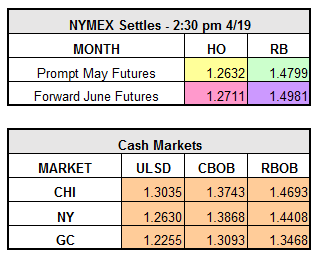

WTI: $56.38 vs. $41.08 (-27 %)

RBOB: $1.9315 vs. $1.4799 (-23%)

HO: $1.8771 vs. $1.2632 (-32%)

Wall Street Journal Headline today:

“Crude Prices Tumble as Kuwait Oil Workers End Strike”

Wall Street Journal Headline on April 20, 2015:

“Oil Prices Rise as Oversupply Concerns Ease”

It’s anyone’s guess as to where the pricing will settle April 19, 2017.