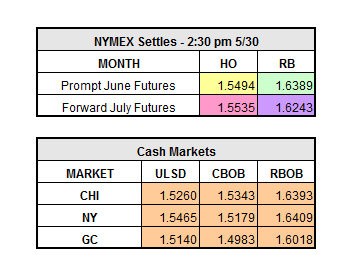

The market was trading down yesterday, after the long Memorial Day weekend. July WTI closed down $0.14 to $49.66/bbl, June HO closed down $0.0139 to $1.5494/gal, and June RBOB finished down $0.0037 to $1.6389/gal. Today is the last day of trading for the June contract. This morning there is continued weakness in the market; as of 9:30 a.m. ET, WTI is down $1.35/bbl, HO is down $0.0350/gal, and RBOB is down $0.0370/gal.

The key news driving the market downward is the disappointment surrounding the OPEC meeting, Libya’s increased production, and the U.S. rig counts. The outcome of the OPEC meeting last week was to extend the production cut of 1.8 million barrels per day until March 2018, whereas the hope was for larger and longer cuts. Libya, exempt from the cuts, is actually increasing production to 800,000 barrels per day this week. Lastly, and probably the most bearish piece of news, is that the U.S. rig count is at an all-time high and it does not seem like production will be slowing down.

Please note, the API and DOE statistics are both delayed a day due to the Memorial Day holiday on Monday. The APIs will be out later today, and the DOEs will be out tomorrow.

Key supports to watch:

WTI: 49.29

July HO: 1.5371

July RBOB: 1.5872

Market closes below these levels could signal continued weakness in prices. Currently the market is well below these values, with both HO and RBOB off over $0.04/gal.