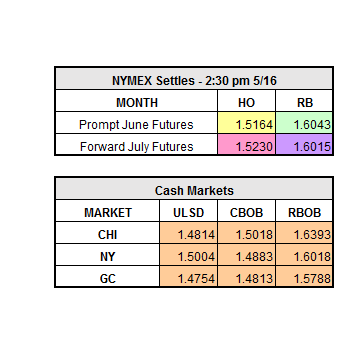

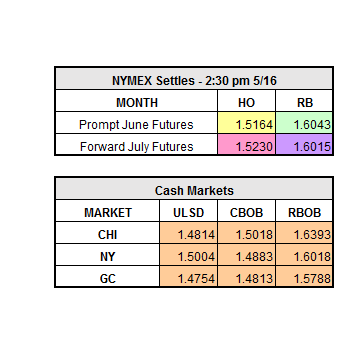

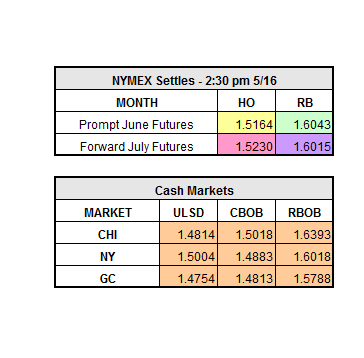

The rally on Monday from the rhetoric around Russia and Saudi Arabia agreeing to extend production cuts continued into Tuesday’s trading session with refined products slightly up all day. RBOB closed up $0.0089 to $1.6043/gal, HO closed up $0.0068 to $1.5164/gal, and WTI finished down $0.19 to $48.66/bbl. After the APIs were released yesterday afternoon the market came off at first then rebounded somewhat this morning because of a weaker U.S. dollar. The API statistics showed a build in crude inventories of 882,000 barrels vs the expected 2.3 million barrel draw. Distillates showed a build of 1.8 million barrels, while the only bullish stat was gasoline with a draw of 1.8 million barrels.

The DOE statistics released at 10:30 a.m. ET were very different from the API report. The DOEs showed a 1.8 million barrel draw in crude inventories; PADD III accounted for the decrease because it drew 5.5 million barrels. Distillate inventories drew 1.9 million barrels, and gasoline drew 413,000 barrels. The bullish statistics had the market rallying across the board. As of 11:30 a.m. ET, HO was up the most at $0.0275/gal, RBOB was up about $0.0075/gal, and WTI was up $0.60/bbl.

Back to the OPEC/non-OPEC rhetoric. The meeting to decide if production cuts will be extended is about a week away, scheduled for May 25th. The assumption is that cuts will be extended another nine months, since most countries already expressed they are in support of it. An agreement would most likely cause oil prices to rally. U.S. production could stay the same or even increase with the help of higher oil prices. With the two opposing factors, it will be interesting to see how volatile the market will be.