The market is seesawing today after the Department of Energy (DOE) released petroleum statistics this morning. Crude supplies built by 9.5 million barrels (MMb). Gasoline supplies built by 2.9 MMb, distillate supplies drew by 0.7 MMb. Crude oil inventories in Cushing, OK drew by 0.7 MMb, and refinery runs dropped 2.3% to 85.4% of operable capacity.

This crude build was in line with API data released last night indicating that crude had built 9.9 MMb. However, there was contrast between these two reports on the refined products. Gasoline was supposed to build by only 0.7 MMb and distillate was supposed to build by 1.5 MMb.

The biggest takeaway from this report would be the draw in Cushing oil inventory and the decrease in refinery run rates. This corresponds with the fact that Gulf Coast refineries are hitting turnaround season for the springtime. They are slowing refined product output and thus building crude inventories while they ready their refineries to produce summer grade gasoline.

According to Fitch ratings, big oil companies require $50-60 per barrel orders to break even. At writing WTI crude oil trades down $0.15 to $53.05 per barrel. It seems like we’ve been trading range bound between $50-55 per barrel and that may continue unless we receive any new news about OPEC’s production cuts.

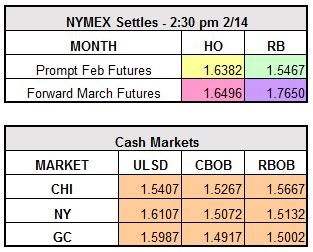

RBOB currently trades down $0.003 to $1.5437/gallon and ULSD trades down $0.0096 to $1.6286/gallon.