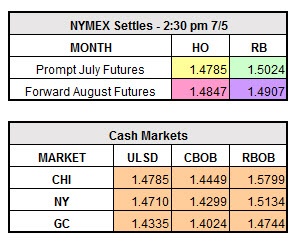

Prices are making their way back today after the significant drops yesterday. The market closed down across the board yesterday; August HO was down $0.0343 to $1.4785/gal, August RBOB closed down $0.0324 to $1.5024/gal and WTI Crude finished down $1.94 to $45.13/bbl.

API’s were bullish with large draws in both crude and gasoline, which is partially to blame for the market on the rise later in the day yesterday and also this morning. Crude drew 5.8 million bbl, a surprise to analysts who were expecting a smaller draw of 2.83 million bbl. Gas drew 5.7 million bbl, and distillates built 375,000 bbl. Oversupply is still very much a concern for analysts after the largest one day loss in crude in over a month yesterday of about 4 percent. The DOE numbers were bullish as well, showing crude inventories down 6.3 million bbl, gas down 3.7 million bbl and distillates down 1.9 million bbl.

OPEC exported 25.9 million barrels per day in June, about 450,000 bpd more than the month of May, marking a second consecutive month of increases. Another piece of information to note is that the US drilling rig count was down this past week for the first time in six months. It will be interesting to see if this is just a one-time occurrence or will continue into a downward trend.

Currently as of 10 a.m. ET the market is trading up, August HO up $0.0132 to $1.4917/gal and August RBOB up $0.0219 to $1.5243gal.