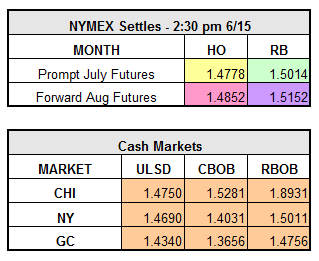

The market is falling for the fifth consecutive day after surprisingly bullish EIA data, currently trading down about 0.0500 on HO and 0.0300 on RBOB. Yesterday, HO settled down $0.0242 to $1.4778 and RBOB fell $0.0199 to $1.5014 on the NYMEX. July WTI crude finished down 48 cents to $48.01.

The oil market has dropped 8% since last Thursday, having shed over 9 cents on HO since last week. EIA data released yesterday clearly contradicted Tuesday’s API estimates. Crude inventories fell 933,000 bbls compared to an API estimated build of 1.2 million bbls, and gasoline drew 2.625 million bbls compared to the API build of 2.3 million bbls. Distillate stocks also increased 786,000 bbls, about 2.9 million bbls less than the API figure.

Despite an overall draw, gasoline inventories built by 1.2 million bbls and distillates built by 1.29 million bbls in PADD 1. PADD 1 (East Coast) encompasses New England, Central Atlantic, and Southeast states, including New York, which may be why we are seeing such a strong sell-off. Demand rose for both gasoline and distillates last week.

With 531 million bbls currently in storage, crude is still in surplus. Despite numerous supply disruptions last month, including the Canadian Wildfires and multiple attacks on the Nigerian pipelines, OPEC and non-OPEC members are pumping out crude at such high rates that even such disruptions don’t seem to have a meaningful impact on supplies.

In other news:

The Niger Delta Avengers have blown up another pipeline owned by the country. This is the second attack this week.

French CGT union workers’ strike protesting planned labor reform is now in its fourth week. Union workers have extended a strike at the Fos-Lavera oil terminal until Friday, June 17th.

On June 20th Norwegian unions and rig owners are set to negotiate an annual wage deal, and unless an agreement is made by the 22nd, nearly 300 oil and gas drilling rig employees could go on strike.