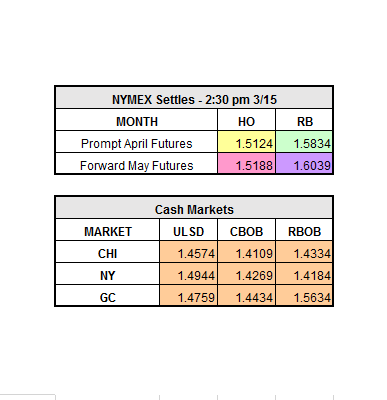

As many people are busy filling out their NCAA Basketball Tournament brackets, energy analysts are diligently trying to understand and predict what the futures market will do next. The DOE’s were released yesterday and finally put a halt to the nine week streak of crude builds. Crude inventories drew 237,000 bbl, surprising analysts who expected a 3.7 million bbl build. Everyone loves a good upset right? With draws across the board, the market traded higher yesterday and continues to strengthen early this morning. WTI Crude closed at $48.86/bbl, up $1.14. Oil price increases can be attributed to the decline in the U.S. dollar. On the refined products side, yesterday the market closed at to $1.5124/gal, up $0.0205 and April RBOB closed down to $1.5834/gal, down only one point.

There are two other important sections of news worth noting. First, the increase in interest rates yesterday from .75% to 1%, which is the second time in only three months. This is a sign that the economy is improving. Second, Saudi Arabia, one of the ringleaders of OPEC still has not come to a decision about reducing supply, but Kuwait, a smaller member of OPEC is in favor of an extension in production cut.

Currently as of 10:20 a.m. ET the market has lost some of its momentum on the distillate side and front month HO is trading at $1.5048/ga,l down $0.0076, while front month RBOB is trading at $1.5887/gal, up $0.0053.