This winter’s start is eerily similar to last year: it has been unseasonably warm. This has been disastrous to the natural gas market and the effects will soon be felt by the heating oil industry as well.

From the start of October this year until November 16th, three highly populated heating markets have seen temperatures far warmer than their 10 year averages. Boston, Chicago, and Philadelphia have been 4%, 13%, and 5% warmer than average, respectively. These markets primarily use natural gas for heating, and that commodity’s price has been bashed over the past month. December NYMEX Henry Hub Natural Gas futures have fallen 24% since October 10th, with futures currently trading around $2.70/dk (dekatherm). This comes as storage in the ground has ballooned to 4.047 tcf (trillion cubic feet), surpassing last year’s level for the same week, 3.996 tcf. Some traders have given up on this winter and are concerned stocks could exceed storage capacity in 2017.

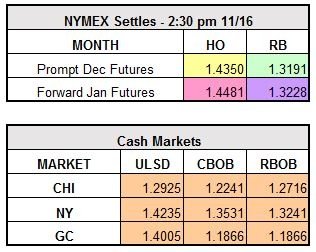

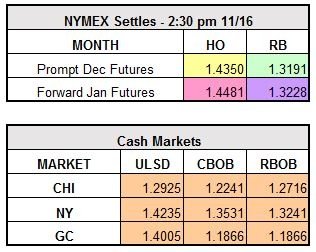

This fear of stocks swelling is also evident in the heating oil industry. Current distillate fuel oil stocks stand at 148.9 MMbs, higher than last year’s level of 140.3 MMbs. Bear in mind, the prompt month NYMEX ULSD contract fell from a high of $1.5812 last year on November 4th to $1.0709 on December 31st. Last year we had a warm start to the winter, a glut of heating oil stocks, and no OPEC production cut. The current NOAA 8 – 14 day forecast predicts temperatures will be cooler-than-average along the east coast. These forecasts will need to be more consistent, otherwise this winter could be shaping up to be just like last year with decreasing prices as the result. December ULSD currently trades at $1.4604/gallon.